While energy sector attention is focused on the low-carbon narrative, the short-term outlook for upstream activity is positive as we head into 2022. Consensus amongst industry analysts point to significant percentage increases in activity for next year, with further increases in 2023 and beyond.

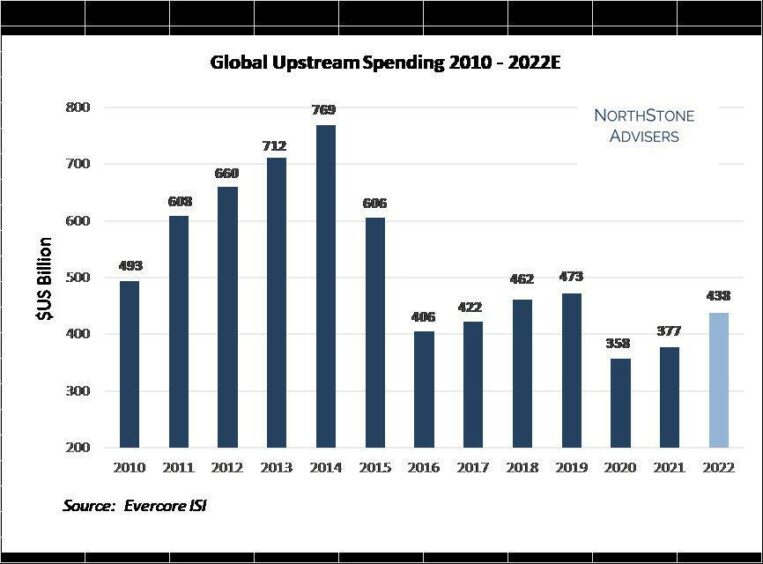

According to Evercore ISI, an investment bank, upstream spending is poised to witness 16% growth over 2021 levels, reaching $438 billion next year. This is being fuelled by a 21% rise in North America, in addition to high-teen gains in the Middle East, Latin America, and Africa.

Investment is expected to mirror Evercore’s value, the growth rate is lower due to a higher 2021 baseline. This sentiment is echoed by Wood Mackenzie, a research firm.

All key producing basins are expected to see gains, driven by North American shale at 18%, and oil sands at 14%. Onshore and the offshore shelf are expected to see 4% increases, while deepwater will grow by 6%, say Rystad.

Fuelled by near record cashflow in 2021 due to improved commodity prices and aggressive cost reduction initiatives during the 2020 downturn, exploration and production (“E&P”) firms are starting to approve large field developments, which have more than doubled in 2021.

In spite of a cash frenzy, new approvals remain cautious. Average breakeven prices used to evaluate new projects are at $40 per barrel or below. As such only the most attractive projects are making the cut, providing downside risk from medium and longer-term commodity price threats.

With a Brent price of around $73 per barrel at the time of writing, the upstream market is in a healthy place. There are demand side headwinds in the short-term due to uncertainties surrounding the economic impact of the Omicron variant, while on the supply side, additional barrels are due to the enter the market from OPEC+ production increases and non-OPEC production growth.

In spite of this, consensus estimates for Brent oil over the course of 2022 remain around $70 per barrel, providing more than sufficient headroom to support new project sanctioning. Longer term, the substitution threat from low-carbon power weighs heavily on E&P investment decision making.

Do we need to continue investing in hydrocarbons?

Clearly, society needs to reduce its reliance on hydrocarbons and invest in cleaner energy to prevent a climate catastrophe. Yet we have a global energy system which relies on hydrocarbons for electricity generation, industry and transportation, in addition to numerous other key products including plastics.

While the International Energy Agency (“IEA”), a global forecaster, has called on all new oil and gas investment to cease on the basis that low-carbon energy can substitute over the next three decades, their analysis is clearly too optimistic.

By their own admission investment in low carbon energy is not moving quick enough, which in turn will put a call on hydrocarbons to fill the gap. According to the Energy Information Administration (“EIA”), a US government department, oil demand will continue to grow by 20% from the current 100 million barrels a day through to 2050, based on current policy and technology trends.

The Outlook for Oilfield Services (“OFS”) Providers

Increased activity will provide a much-welcomed stimulus for the global oilfield services community, still reeling from the 24% decline in spending witnessed in 2020. While investment is significantly down from the $769 billion peak witnessed in 2014, participants have adjusted capacity to reflect a much lower baseline of activity.

The supply and demand balance is still out of sync, and while pricing of OFS is expected to increase by around 10% next year, mainly driven by inflation in transportation and raw material prices, these are primarily pass-through costs. As such only minor margin improvement will be realised over the course of next year as OFS capacity remains oversupplied.

Yet the OFS sector is shaping up for more prosperous times. We expect an upward trend in investment to occur over the coming years which will lead to tight markets and opportunities for wealth transfer from E&P companies to OFS.

To quote Schlumberger’s CEO during their 3Q21 earnings call, a leading OFS firm, “strengthening industry fundamentals, combined with the actions of OPEC+ and continued capital discipline in North America, have firmly established the prospects of an exceptional multiyear growth cycle ahead.”. We agree.

Since the 2014 downturn, the main publicly traded OFS providers have shed around 40% of their workforce. This has been coupled with facility closures, reduced manufacturing capacity, and heavy asset retirements such as drilling rigs, construction and support vessels.

As demand grows and activity rises, a major issue in the supply chain will be that of capacity which we expect to start to tighten in 2023 and beyond. This in turn will present the opportunity for pricing improvements and stronger returns from a badly beaten sector.

And things will be different this time. In past cycles OFS firms have responded to upturns in activity by investing in new equipment, personnel and manufacturing capacity as opposed to managing supply and driving pricing gains.

With new capital availability, both equity and debt, practically absent from the sector, OFS firms will increasingly have to invest from cashflow. In order to do this, they will need to drive higher returns to finance investment. In effect, E&P firms will need to financially support their suppliers.

Over the next decade, we remain optimistic about the outlook for upstream investment and activity increases for OFS firms in their incumbent markets. This said, while the energy transition will take decades to progress, there is a looming reality of peak oil and gas demand occurring at some point as policy and investment aligns with the need for a lower carbon world.

A Pivot towards Low Carbon Markets?

OFS firms are clearly not immune to this change and will have to adopt new strategies and operational models to remain relevant, and investable in the future.

We are of the view that they have three choices. To profit maximise in their traditional markets – a last person standing approach. Secondly, to start to pivot towards growth markets in new energy or other industrial applications, or thirdly, fully pivot completely into new sectors.

While OFS firms currently active in engineering, construction, project management, logistics, process equipment, professional and maintenance services can theoretically pivot towards new market opportunities, many will find any transition more difficult as product and service offerings have little application outside upstream markets.

Irrespective, all OFS providers will need to determine what they want to be in the future, backed by robust and evidence-based analysis of the opportunities, determining their long-term vision, while also evolving their operating models.

Achieving this is no mean feat given the uncertainties surrounding activity levels and OFS oversupply in upstream markets, while emerging markets such as carbon capture, utilisation, and storage (“CCUS”) and hydrogen are still in their infancy, and the larger scale offshore wind sector is challenging commercially.

Many traditional OFS players in Europe have already pivoted towards the offshore wind market which has provided valuable revenue streams as upstream activity plummeted. With around $30 billion of investment expected each year for the next decade, the sector provides material market opportunities for engineering, fabrication, cable manufacturers and construction providers in the North Sea.

Growth potential remains in Europe over the medium to longer term, while future growth opportunities exist in less mature markets such as the US which will start to gain traction in the coming decade. While operational models will be broadly consistent with the European approach, there are some material differences to the US market which European players will need to address to prosper.

Other much championed sectors such as CCUS and hydrogen are much more nascent. While actual investment levels are difficult to pin down, the IEA estimates that CCUS investment was $4 billion and hydrogen $3 billion during 2020. Rounding errors in the wider energy environment.

The potential for growth is outstanding. Forecasts suggest that CCUS could see 56x times growth to $205 billion and hydrogen markets 46x growth to $165 billion by 2030. Rounding errors no more.

The challenge is that the timing of investment, the technologies to be adopted, and the economics of projects are uncertain and strained at this point without government support. Understanding what to do, and when is a real challenge to business seeking diversification in these, or any sector.

Andrew Reid is a partner at NorthStone Advisers, a provider of energy sector research and consulting services including market research, growth strategy support, and organisational development support www.ns-adv.com.

Recommended for you