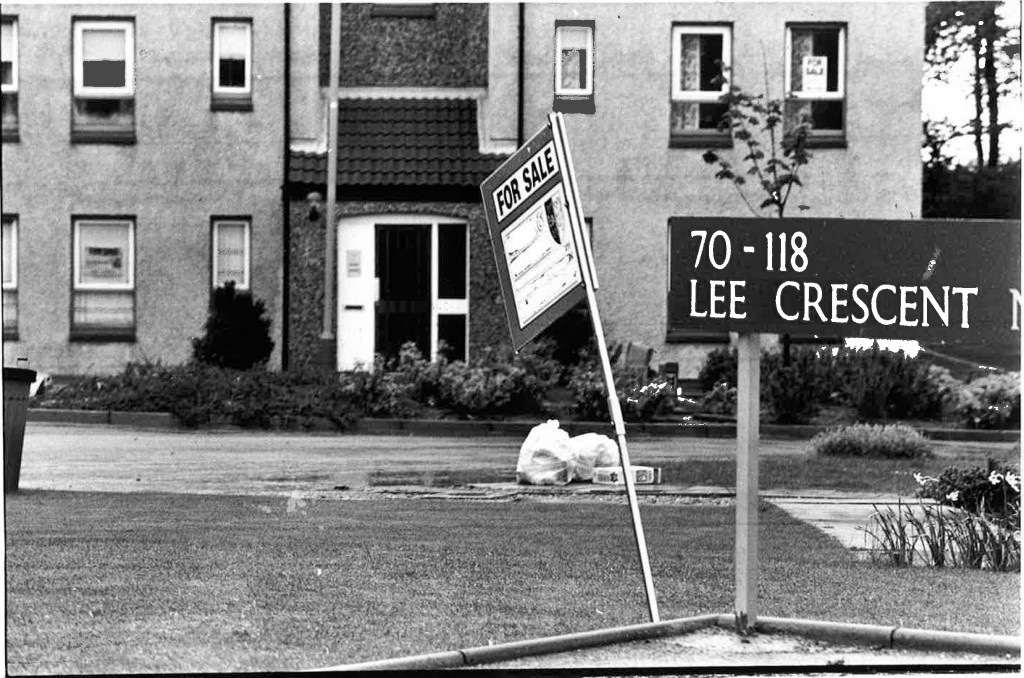

As a bellwether for the state of the Aberdeen economy, one street came to symbolise the boom and bust of the oil industry in the 1980s.

Lee Crescent North, which was home to many who prospered thanks to “black gold” in Europe’s oil capital, became a shorthand for an industry in crisis – the backside had fallen out of the oil market and Aberdeen property prices soon followed suit.

The “for sale” signs sprouted like weeds on a garden path as the aspirational, 80s property-owning dream threatened to become a nightmare, haunted by the spectres of negative equity and unaffordable mortgage payments.

In 1986 the street had more than 40 semi-detached homes, flats and maisonettes for sale out of 470 properties. The average house price in Bridge of Don was £38,101, down from a £41,393 average the year before.

The Press and Journal reported in July 1986 that lay-offs and repossessions were signs of the times as the house market entered the doldrums. Oversupply of homes and the oil recession were a double whammy that led to lay-offs in the building trade. The Evening Express later reported that young home buyers were taking on “hefty 100% £25,000 mortgages” in Aberdeen.

As the industry endures a similar downturn, Energy Voice looked to Lee Crescent North to see if history was repeating itself.

Today, the street tells a different story.

Only two houses in the street are currently for sale on the Aberdeen Solicitors’ Property Register and one, one-bedroom maisonette is available to rent via ASPC.

House prices in Aberdeen have remained steady in the second quarter of 2015 but the volume of sales has dropped.

In 2015 the average price for a flat was £167,589, a semi-detached house was £231,904, and a detached house was £355,782.

Keith Allan, managing partner of Aberdeen legal firm Raeburn Christie Clark and Wallace, remembers the mid-80s oil crash well.

“I was here and working in property at the time. It was as bad a spell as I have ever experienced in 40 years in the profession.

“The crash of 1986-87 was the first full oil industry recession that we had experienced and it really frightened everyone. People thought Aberdeen was going to become a desert. Fear and uncertainty led people to panic.”

But fast forward almost 30 years and it appears the housing market – Aberdeen has outperformed the rest of the country in recent years – remains in good shape.

Allan said: “There is still good activity if the property you are looking for is priced with a one, two or three. It is properties in the £350,000-plus range where there is less activity.

“This could be caused by a lack of confidence in the jobs market – particularly in oil and gas, a potential rise in the cost of borrowing and also the introduction this year of the Land Buildings Transaction Tax, which replaced Stamp Duty and has made prices at the upper end of the market that bit more expensive to buy.”

“The market should be able to withstand the current oil industry issue. Sellers in the upper levels realise they are not going to get a premium on their price at the moment.”

The April-June period in Aberdeen city and shire maintained the same price levels as the first quarter of 2015. However, the volume of sales is down 9.4% on the same period last year.

Allan added: “My view is that the 2015 figures are holding up well. Borrowing is still historically low and there is very good activity in starter homes and flats. If we have that, the market is underpinned.”

He believes many people feel that they had been through tough times before and are not panicking.

“The pub talk and café chat may be downbeat, but the market is fine, steady and sustainable. The stats do not lie.”

John MacRae, chairman of Aberdeen Solicitors Property Centre said when the latest figures were revealed: “Undoubtedly, the continuing problems in the oil industry will also be having an effect and, given past experience of similar situations, I do not think the effect of the oil price is yet fully reflected in our local market activity.”

Dave Farquharson, moved into a brand new property in Lee Crescent North in 1987, and has lived in the same two-bedroom house since. He has also worked in the oil industry throughout.

He recalled: “From what I remember I think a lot of people sold to move up the housing ladder. There were a lot of young people and a mix of properties.

“There have been a few downturns [in the oil industry] since then but I don’t remember a lot of houses going up for sale here every time it happened.

“It really was the best place for us. We brought up two boys here and there was always a real family atmosphere in the street. There was always an adult to look out for the kids when they were playing on the grass.”

“One of the biggest changes has been the number of cars parked in the street, most households have two, even three cars nowadays.”

“But we’ve been here 28 years and it has been a great place to live.”

Recommended for you