Today, I’m going to try and tackle the reasoning for my ‘wild’ predictions for oil reaching triple digits by the end of 2017.

While I am nearly alone in these forecasts, they are not just pulled out of space, but with deep regard for the fundamental supply/demand picture that everyone mostly agrees upon, combined with what I think is a deeper insight into the likely trajectory of oil company leverage, financing and the role of financial oil derivatives.

Despite the technical nature of this discussion, I think I can make a strong case for $120 oil in 2018 using only two charts of my own making – one charting global demand, which is more universally agreed upon, and then an overlay of global production, which is more open to prediction.

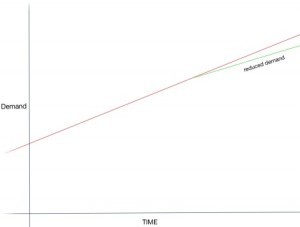

First, demand: Almost all analysts including the EIA and IEA agree that demand continues to grow at a steady pace throughout the rest of the decade, and even a minor economic downturn will only slow the pace of growth (green line), but not upend the upward trend line of demand. Sorry to those environmentalists who pray for an end to carbon use growth in the next decade – virtually no one currently believes it will happen.

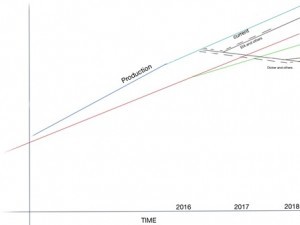

Now, let’s overlay the rudimentary global production line(s) on top, put some likely dates on this chart and describe some of the possible scenarios:

First, we notice that the blue line of production going back before the oil crash is steeper than the demand line – hence the current gluts we are experiencing and low barrel prices. Low prices have made production growth begin to slacken, which I’ve indicated by easing the slope of the light blue line. It’s clear that if nothing else happened from here, we’d still see future production outstrip demand – hence some analysts’ fear of never seeing triple digit oil prices, or at least a much lower for much longer scenario.

But most analysts agree that the sharp drop in Capex budgets, not just among shale producers, will have its effect on sharply lowering production this year and putting growth in reverse, efficiencies and well cost reductions notwithstanding. What’s critical to note is how the media, and surprisingly most analysts, see global oil merely through the prism of U.S. independent shale players. To me, this is the critical grave mistake they make. Recent lease outcomes in the Gulf of Mexico, problems in Brazil and the likely end of spending for all new Russian oil projects are just a few of the other gargantuan gaps in global production we’re likely to see after 2016.

I’ve drawn two lines in black on production; one that most of the analysts including the EIA are making in how they see this production curve playing out, and mine – how I see it likely playing out.

While the EIA and most other analysts agree that sharp capex drops will begin to have their halting effects on oil production, they tend to argue over when those production drops come and how steep they will be. In all cases, they argue that any drop in production will be answered by a rally in oil prices, to the degree that U.S. shale players again ‘turn on the spigots’ and reestablish the gluts that have kept us under $50 a barrel for most of the last year. In this scenario, production never – or at least exceedingly slowly – rebalances to match demand.

I see it much differently. I could argue that the shale players, even with their low well drilling costs and backlog of ‘drilled but uncompleted wells’ (DUCs) cannot in any way repeat their frantic production increases they achieved from 2012-2014 ever again. I believe this because of financing constraints and the lack of quality acreage among other reasons – but I don’t have to even “win” this predictive argument.

Longer-term projects from virtually all other conventional and non-conventional sources that have not been funded for the past two years will see their results, in that there won’t be the oil from them that was planned upon. Chevron estimated in 2013 that oil companies would have to spend a minimum of $7-10 trillion dollars to 2030 to merely keep up with demand growth and the natural decline of current wells. And this was without factoring in the drop in exploration spending that is occurring now and throughout the next two years. Severe capex cuts from virtually every oil company and state-run producer over the last two years has put this necessary spending budget way behind schedule.

You can see why I tend to have a much more radical view of the decline line in production beginning in late 2016 and lasting, in my view, at least until the middle of 2018, when production again only begins to get the funding (and time) it needs to try and “catch up”.

Meanwhile, there will be, as I see it, a violent crossing of the demand and supply lines in my graph – and an equally violent move in the price of oil because of it.

Finally, when this trajectory becomes obvious, the financial markets will waste no time taking full advantage of it – with a massive influx of speculative money, driving up prices even more quickly and steeply.

I’ve seen that before – and am currently alone in believing how close we are in seeing it again.

Dan Dicker is a 25 year veteran of the New York Mercantile Exchange where he traded crude oil, natural gas, unleaded gasoline and heating oil futures contracts.