Good news stories from West of Shetland where the march of technology has gradually bridged the gap between impossible and attainable.

Next year will mark the 40th anniversary of the Clair field’s discovery and, all going well, it should see the first oil being transported from its second offspring, Clair Ridge.

Meanwhile, another Clair infant was in the very early stages of gestation 18 months ago. Though BP are likely to keep it in the incubator for quite a while yet, the “investigative” process is continuing.

It’s a potted history which points to the great enigma that lies West of Shetland. On the one hand, it has been around for a long time with a general consensus regarding the substantial resources of oil & gas to be found there, with varying degrees of accessibility.

On the other, it is still spoken of as “frontier territory” which carries hopes that it holds one of the most critical keys to the UK industry’s future.

The basic reasons for this enigma are, of course, costs and conditions. The investment needed to go find let alone develop fields in the deep and stormy waters of the Eastern Atlantic has been eye-watering, even by comparison with the North Sea.

To a critical extent, therefore, many companies put West of Shetland on the back burner until other options were explored and exhausted.

However, the march of technology gradually bridged the gap between impossible and attainable.

It took until 2001 for BP to get to the point where a plan which led to development of the Clair field by 2005 could be approved. That was thanks to a huge amount of effort cracking the field’s geological code and the advent of horizontal “intelligent” wells technologies.

Success with Clair phase one in turn opened up the Clair Ridge possibility into which billions of pounds have been sunk in pursuit of another 640million barrels of recoverable resource.

One might think that, in the current environment of low prices and no certainty of recovery any time soon, there would not be much good news linked to the words West of Shetland. Quite the contrary.

Indeed, the fact that the reality is different offers hope that there are players in the industry still taking a longer-term look at what might be possible, rather than simply retrenching in response to the gloomy prognosis.

Some of the good news – not least with Clair Ridge – inevitably results from investment decisions that were taken a good few years back in a very different economic environment.

The UK government approved that project in 2011 and all the big orders were placed before the oil price went off a precipice. Last month, the final modules left the Hyundai yard in South Korea, en route for West of Shetland.

Even though the project has been long in the planning, it will be a big boost to morale when the topsides are installed this summer and an even bigger one when oil starts flowing to Sullom Voe next year.

With a life expectancy of more than 30 years, the signal from Clair Ridge will be that development West of Shetland is both more feasible than at any time in the past and also a shrewd long-term investment.

That is clearly understood at Hurricane Energy which has raised £52million to fund two wells on the Lancaster Field which lies 60 miles West of Shetland. Kerogen Capital has taken the lion’s share with Crystal Amber, Hurricane’s largest investor before this, making up the balance. Both are well-regarded as shrewd international investors.

Hurricane is pursuing so-called “basement” oil in deep fractured granites and its pioneering work shows significant promise.

I was interested in the view expressed in the newsletter Interactive Investor which noted that pilot production could happen as soon as 2019 and concluded that with the potential resource involved “and a potential farm-out in the pipeline, the stock is ludicrously cheap”. This is the kind of counter-intuitive sentiment that the industry needs to hear more of – that opportunities are relatively cheap and this is the time to invest!

There will be another good news story from West of Shetland later this year when the new FPSO, Glen Lyon, linked to state-of-the-art seabed infrastructure and seabed technology will breathe new life into the Schiehallion field where operations were suspended in 2013 after 15 years of wear and tear in the ferocious conditions that characterise that part of the UKCS.

This is a £3billion development which ensures that the Schiehallion and satellites will be producing for a couple of decades or more to come.

Once again, this represents a huge investment by BP whose faith in West of Shetland has been absolutely critical, both to opening up the frontier and then keeping it alive through thick and thin.

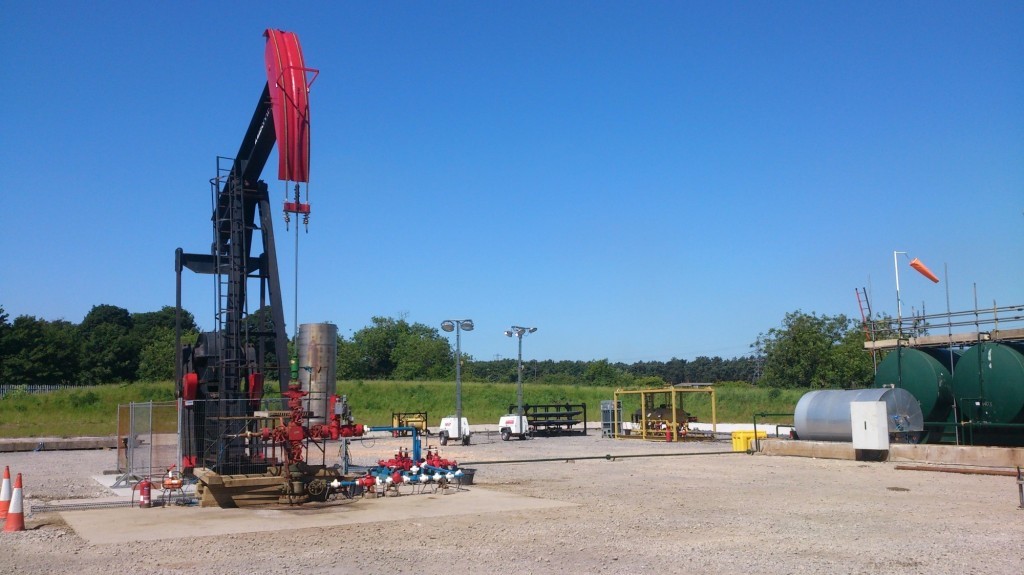

Then there is the Solan field, which produced its first oil last month after a long and arduous struggle again hostile weather conditions and rising costs which tested the commitment and resources of Premier Oil to the limits. But they have come through all that and another 25,000 barrels of oil a day will flow as a result.

Last for now but far from the least is Total’s Laggan-Tormore gas development that, following investment of £3.5billion, started piping gas to Shetland in February. The Laggan discovery goes back as far as 1986 but it was only the Tormore find that made it eventually economically viable. The project was set back by a year due to weather conditions but that hostility has been overcome.

Not only that, it has laid the foundation of gas infrastructure in the West of Shetland sector. When the gas reaches the mainland, it will supply up to 2million UK homes for decades to come – a valuable contribution to the security of our future energy supply.

So there you have it – a quick tour West of Shetland and there are at least half a dozen positive stories to report upon. Of course it does not diminish any of the challenges which the industry faces more generally or even imply that all of these projects would have been given the go-ahead in today’s circumstances.

But at a time when good news is in short supply, it is worth noting that there are developments coming to fruition on the UKCS or in the pipeline which ensure that we will have a substantial oil & gas industry for several decades to come – while, at the same time, keeping alive the hope and expectation that one day West of Shetland, when the world has gone through a couple more economic cycles, might even be as big as what has gone before.

Recommended for you