Vladimir Putin appears to have joined Lewis Carroll’s Alice on her trip through Wonderland, where nothing is quite what it seems, at least as far as talk of an oil output freeze is concerned.

The Russian president appears keen to patch together the pieces of an accord for a freeze when his delegates and OPEC officials meet in Algeria later this month. A potential agreement was smashed apart in April when Saudi Arabia refused to take part at the last minute — it and other Gulf nations were unable to swallow an exemption for Iran.

“From the viewpoint of economic sense and logic, then it would be correct to find some sort of compromise,” Putin said in a Bloomberg News interview in Vladivostok on Sept. 1. Such an agreement is impossible without the assent of the kingdom. Putin expressed his thoughts on this, when he added that Deputy Crown Prince Mohammed bin Salman “is a very reliable partner with whom you can reach agreements, and can be certain that those agreements will be honored.”

Can Putin, a man whose warplanes were recently bombing Saudi-backed rebels in northern Syria, really persuade the kingdom to grant concessions on output to Iran, which is backing rebels fighting Saudi troops in Yemen? It seems a big ask, but it could yet work.

Saudi Arabia may not mind freezing at current levels. After all, its output last month, at 10.69 million barrels a day, was more than it has ever produced in the past, and almost 500,000 barrels a day above the level that it was contemplating as a ceiling back in April.

More to the point, the world has moved on. Countries are starting to recognize that Iran, which was subject to international sanctions until just a few months ago, should be allowed to continue raising production. It is, in any case, close to pre-sanctions levels and may not be able to increase much further, so there’s less cost to giving them an exemption this time around.

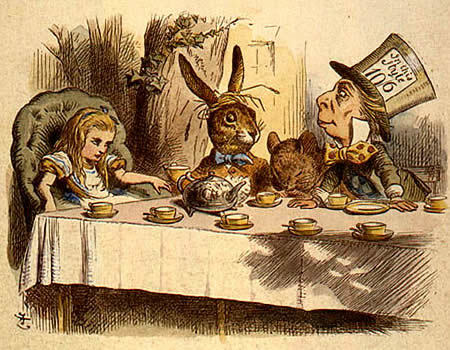

But if Putin is able to broker an exemption for Iran, as he hopes, then others will also surely expect to join that tea party.

Nigeria’s production is as low as it has been at any point in the past 27 years, with a series of attacks on pipelines in the Niger River delta region. No sooner had the militant group currently hogging the headlines declared a ceasefire than two more sprang up to continue the attacks. Nevertheless, if attempts by the government to restore peace in Nigeria’s oil patch are successful, then we can expect a surge in the country’s production to add as much has 500,000 barrels a day to global output.

Add if Nigeria is given a free pass, then what about Libya, or Iraq? The North African country hopes to restore flows through two of its biggest export terminals, which could more than double production to around 600,000 barrels a day once the necessary repairs have been completed.

Iraq, as I wrote last week, has just asked oil companies operating in the south of the country to revive investment plans shelved earlier this year, with the intention of boosting output. It has also resumed pumping oil from Baghdad-controlled fields in the north through the Kurdish pipeline to the Mediterranean, which could boost exports by 150,000 barrels a day in a matter of weeks, if the deal holds.

The Saudis should want to stand firm. It’s adopted a policy of producing as much oil as demanded both at home and abroad, arguing that a period of lower prices is needed to weed out high-cost producers and rebalance the market.

That view has not changed. However much Iran might deserve an exemption, the logic of standing fast isn’t all that topsy turvy. The last thing the Saudis should want is to impose any real output restrictions that would throw a lifeline to hard-pressed producers of expensive crude.