On a global level, 2015 and 2016 marked the lowest level of new conventional oil discoveries since 1952. In 2016, only 3.7 billion barrels of conventional oil were discovered, roughly 45 days of global crude consumption or 0.2 percent of global proved reserves. Globally, exploratory drilling fell by almost 20 percent in 2015 and fell even further in 2016. Russia’s exploration activities, which were hit not only by plummeting oil prices but also by a targeted sanctions regime, suffered a double blow during this period. In 2015, only seven new hydrocarbon discoveries were made in Russia, three of them in the Baltic Sea. In 2016, oil and gas companies in Russia discovered 40 prospective fields, however, the 3P reserves of the largest among them, Rosneft’s Nertsetinskoye, amounted to 17.4 million tons. This stands in stark contrast with pre-sanction period achievements, for instance, 2014’s largest find, Pobeda, is believed to contain 130 million tons of oil and 0.5TCm of gas.

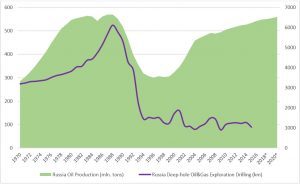

Graph 1. Russia’s Oil Production 1970-2020 and Russia’s Deep-Hole Oil & Gas Exploration Drilling.

Source: Russian Central Bank, IEA, Russian Statistics Agency.

It is only logical that against such depressive trends, that people start to question the sustainability of Russia’s current oil-producing renaissance (Graph 1). When will Russia run out of oil? Were Sheikh Yaki Zamani’s “Stone age” simile to materialize, would Russia still be among the top producers when oil started its descent towards obsolescence?

The Ministry of Natural Resources and Environmental Protection of Russia states that not accounting for new discoveries, current oil reserves in Russia stand at 29 billion tons and under current consumption rates would be depleted by 2044 (its 2P gas reserves’ depletion would come about in more than 160 years). To this end, it would like to implement business-easing measures, e.g.: facilitate the issuance of licenses and to increase the size of the allotted subsoil block to a maximum of 500 km2 (which would mean a fivefold increase compared to existing regulations). The Ministry’s stimulating measures, however, should not obfuscate the fact that Russia still has vast amounts of untapped reserves waiting to be discovered. But where?

Frontiers

The future of Russian crude lies in oil that is more expensive, more geologically complex and further away from traditional regions of production. Just as West Siberia replaced the Volga-Urals Region in the 1970s as the Soviet Union’s main producing region, East-Siberia and offshore regions will overtake West-Siberia (which saw its share in the national output diminish from 71 percent in 2004-2005 to 57 percent currently). This change of “leaders” is long overdue as West-Siberia oil output was already expected to plummet in the 1990s, yet thanks to extended oil recovery methods and slower-than-expected development of other oil-rich regions it has managed to keep stable output numbers. Russia’s oil sector has been consistently hoodwinked by analysts, who, beginning from the early 1980s predicted an imminent production slump. The production fall did happen, reaching a low-point between 1996 and 1999 when production foundered to 301-305 million tons per year. The cause was to be sought in Russia’s overall economic depression, not in its dearth of resources.

Today, Russian companies are similarly constrained in tackling Russia’s three new oil frontiers – shale, Arctic and deep-water. It is no coincidence that U.S. and EU sanctions targeted the sales of technologies related to these sectors and not conventional – whilst Russian companies are well-equipped to deal with conventional fields, they relied heavily on Western know-how. Yet it is very unlikely that even a tightening of sanctions could stall Russia’s Arctic exploration activities for a longer period of time. Russia’s continental shelf contains most of the Arctic’s oil formations and approximately 60 percent of its undiscovered reserves. So far, the 3P reserves of Russia’s Arctic stand at 585 million tons and 10.4 TCm, yet most of its Arctic Seas were only superficially appraised. The Kara Sea, whose fields are almost exclusively gaseous, has been in the spotlight since the 1983 of the Murmanskoye gas field (120 BCm), yet the northern parts of the adjacent Barents Sea, which Russia’s Federal Agency on Subsoil Usage deems the most likely to yield top hydrocarbon discoveries in the next few years, are relative newcomers in prospective surveys.

Western oil & gas companies should be aware that the Russian government treats Arctic formations as resources of “federal significance” and it is unlikely to provide them a role other than that of a minority shareholder. There is more maneuvering room for oil formations in the riskier part of the Arctic – the as of yet impossible-to-assess Laptev and Chukchi Seas, where no large-scale surveying has been done. Moreover, after the UN Commission on the Limits of the Continental Shelf acknowledged the Okhotsk Sea as a Russian enclave, the least-researched Russian sea can now be prospected and appraised. Still, the Russian Arctic, along with frontier zones like the Timano-Pechora Basin and the Yenisey-Khatanga Basin, will play an important role in keeping Russia among world’s top 3 oil producers in the next 40-50 years. Yet there is more, Russia’s oil future is not only more Arctic, but also more shale-related.Russia has been sitting on vast shale/tight oil reserves, which according to present data are second only to the United States. Yet it might easily surpass all its rivals, as the development of gigantic tight-oil formations, such as Bazhenov Suite, the largest shale deposit in the world covering a territory of more than 1 million km2 and assumed to contain at least 20 billion tons of oil, is still in its infant phase. The potential of the Abalak Suite underlying the Bazhenov, the Domanik Suite, stretching asymmetrically across the Volga-Urals Region from Perm to Orenburg, as well as many others, is still difficult to assess, yet virtually all of them are located in traditional oil-producing regions with a fully-established oil infrastructure. Although the first Bazhenov oil gush dates back to 1969, several factors have hindered the development of Russian tight oil, yet the principal among them was the availability of other, less-costly variants of production. The preference for easier-to-access, less costly formations is aptly reflected in Russia’s curbing of deep-hole exploration drilling (Graph 1).

As Russia’s tight oil needs at least an oil price level of 55-60 USD per barrel, bringing the first fields on-stream is still some way off as conventionals’ breakeven levels are in the 20-30 USD per barrel range. Despite a significant lag compared to the U.S. shale revolution, this might not be that unfavorable for Russia. It is expected that under the aegis of “import substitution”, Russian service companies might be fully up to the task to exploit Russia’s shale bounty by the 2020s, moreover, they are likely to work in an environment with significantly lower drilling costs, time and efficiency rates than their American counterparts in late 2000s (thus yielding more oil). By that time, perhaps, anti-Russian sanctions will be a yesteryear affair.

Lastly, one should not underestimate the tenacity of Russia’s conventional oil reserves, which thanks to enhanced oil recovery techniques and supplementary exploration will remain a force to be reckoned with. As demonstrated by the discovery of the Velikoye field in the Astrakhan Oblast (reserves estimated at 330 million tons of oil), Russia’s pre-salt layers, even in regions previously thought to be on the verge of depletion, might kickstart a new development vector in its energy matrix. As Russia’s Natural Resource Ministry cannot account for events that are still yet to happen, its 2044 depletion assumption reflects merely its inherent conservatism, not the country’s realistic capabilities. By all accounts, Russia will remain a major oil-producing nation throughout the entire XXIst century, with oil production moving to places that are further (north and east), deeper (both deepwater and pre-salt) and generally more costly.

This article originally appeared on Oilprice.com here.