Don’t go getting bored here, bear with me.

Under Section 29 of the 1998 Petroleum Act the owners of UKCS assets have joint and several liability for the decommissioning of the field at the end of its life. And this is entirely reasonable, it is there is to protect UK taxpayers.

To protect each other from default then, the Joint Venture (JV) that own the asset requires guarantees that each respective partner meets its obligations in this regard. In the early years of asset life there is lots of remaining value and therefore should a partner default or go bust, whatever, then the liquidators will sell the asset with its future obligations to a new partner. No problem there. But what happens if there is a risk the remaining value is less than the decommissioning liability?

Well a potential new buyer will need to consider the remaining value closely. And as a shrewd oil man/woman, you will certainly not be looking at the beautifully manicured Information Memorandum (IM) so laboriously produced by the diligent Investment Bank for the sales process. Now I admit, complete with its sumptuous graphics and easy flowing narrative it is a work of art. But no no. The existing partners will be worrying about the risks to the infill program their geologist whispered into their ear, the awful oil price scenarios corporate have made them run, the senior citizen offshore gas compressor with the dodgy ticker or the pipeline inspection which made the possibility of an aneurism lose everyone’s sleep. It is that scenario they will want to hang Section 29 on you with. Whatever goes wrong their job depends on making sure Section 29, or at least your piece of it, never comes over to haunt them.

Now suppose you are a savvy and battle-scarred North Sea buyer very familiar with all the wee tricks used to embellish the valuations in that mesmerising IM. You look at the Discounted Cash Flows (DCF) wandering gracefully across the page and you remember how, very properly, they reduce future cash flows at a discount rate that appropriately represents the risks of the investment being considered. Your trusting and loyal shareholders have put their money in your hands and you intend to spend it wisely. Wait. Then you notice that decommissioning bill at the end, and how it looks so insignificant. How is that possible? Oh oh. DCF doesn’t work with decommissioning. If there is more than one sign change in a DCF then there is potentially more than one solution to the problem, the French polynomial mathematician, Rene Descartes, demonstrated this (although it is unlikely he was thinking of Brent Delta, never mind a DCF at the time). And yes all that is outside the scope of this piece, I’ll just get on with it.

You use the Extended Yield Method to deal with this hocus pocus. Your valuation model has a sinking fund of the later year cash flows that properly models the much more modest returns (if any) your sinking fund yields as it hoovers-up the sunset years of cash flow from the asset to ensure you can cover your bit of the assets funeral expenses. Only one sign change now, DCF is back in the game my friends.

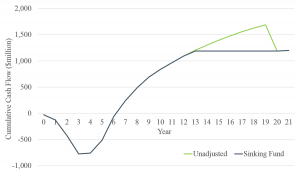

I can tell you’re getting restless. Does all this make much of a difference, or am I just risking your ire on a geeky piece of mathematical purity? Well if it is a big field potentially this isn’t a major issue, at least not today anyway. The chart below shows two cash flows for the same project from year zero to end of field life.

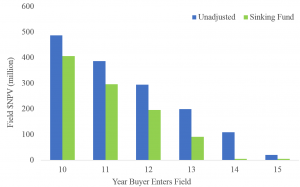

The green line is the cash flow unadjusted. The blue line has a sinking fund to cover the decommissioning liabilities. The IRR of these two cash flows are 19.97% and 19.24% respectively. Not huge I admit, but what if a new partner enters the same project in a later year? The second chart below, with the same cash flows as above, shows the difference in NPV for each differing treatment depending on which year one enters the project. Hope you haven’t used the unadjusted method, if you have you’ve just made a couple of Investment Bankers high-five and roar with laughter, and that’s never a good sign.

But seriously, more and more assets are entering this twilight zone so this is now a very big deal for the North Sea today.

Finally, what if there is not enough positive cash flow left to cover the decommissioning? Well then you’ll need to prove you’re good for the money, and a friendly Investment Bank will provide a Letter of Credit secured against your other assets for that. Oh and charge you 7% for the privilege, more profit down the drain. Oh, and by the way, given you’ve now secured those decommissioning liabilities against them, your borrowing base has been shot to pieces.

It simply doesn’t work. That is why companies cannot buy only mature assets and cope with their decommissioning liabilities. And the companies that can cope? They are probably the ones trying to sell.

Oberon Houston is managing director at Starcap Energy.

Recommended for you