Before America’s Twitter-loving president made it to the Oval Office, a recurring theme was that the U.S. should have gotten hold of Iraq’s oil after toppling Saddam Hussein. There’s this:

Donald J. Trump @realDonaldTrump We should have gotten more of the oil in Syria, and we should have gotten more of the oil in Iraq. Dumb leaders. Twitter: Donald J. Trump on Twitter

And this:

Donald J. Trump @realDonaldTrump I still can’t believe we left Iraq without the oil. Twitter: Donald J. Trump on Twitter

And don’t forget this:

Donald J. Trump @realDonaldTrump We should have taken the oil in Iraq, and now our mortal enemies have got it, and with no opposition. Really dumb U.S. pols! I’m so angry! Twitter: Donald J. Trump on Twitter

Well here’s the thing. America has Iraqi oil. And the loser in all this turns out to be Donald Trump’s favorite Mideast nation.

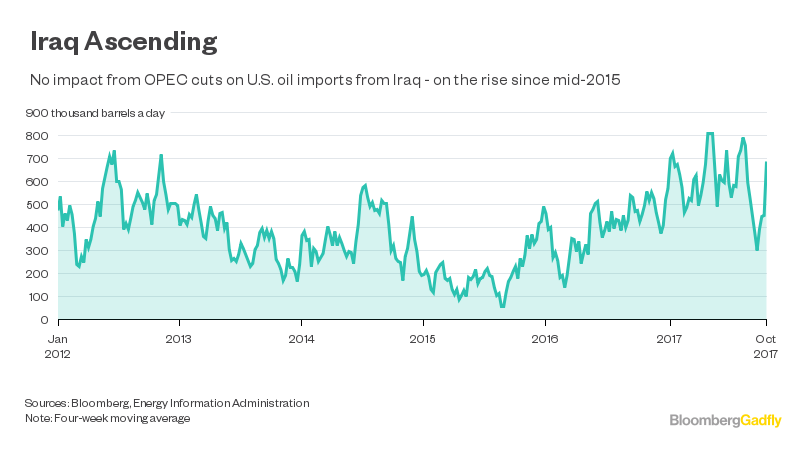

OK, U.S. refiners are buying the stuff, rather than “taking” it — whatever that might mean — but the volume of Iraqi oil entering the U.S. has been on the rise since the middle of 2015 and has continued to increase this year, despite OPEC’s output cuts. Imports of Iraqi crude have averaged 600,000 barrels a day so far this year, according to data from the the Energy Information Administration at the Department of Energy. That’s up by 50 percent from 2016 and is almost three times as much as U.S. refiners bought from Iraq in 2015. The flow through American ports has exceeded 1 million barrels a day three times since the start of June in weekly EIA data.

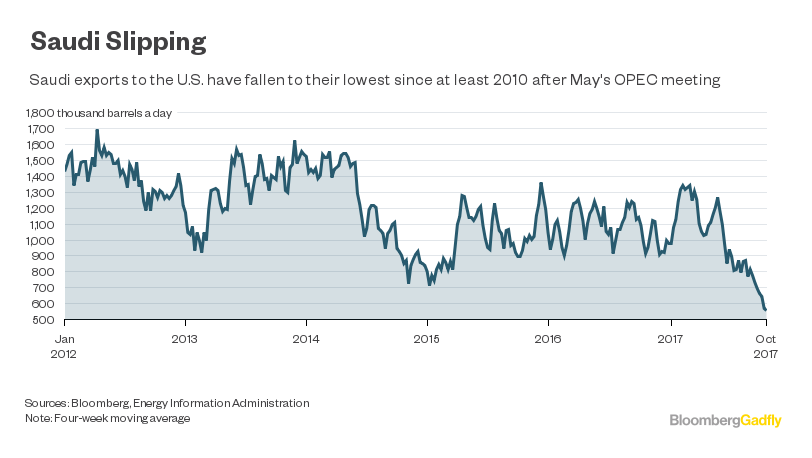

Meanwhile, purchases of crude from Saudi Arabia, have been going in the opposite direction. The Saudis have made good on the promise oil minister Khalid Al Falih made after the May OPEC meeting to “markedly” reduce deliveries to the world’s biggest consumer. “Exports to the U.S. will drop measurably,” he told reporters after chairing a meeting between the group and other major producers in Vienna on May 25.

And they have. After averaging close to 1.2 million barrels a day in the first six months of 2017, they have fallen to around half that level since the start of September. True, a couple of big storms in the Gulf of Mexico have hit individual weekly numbers, but they bounced back after the storms passed and delayed cargoes were able to discharge.

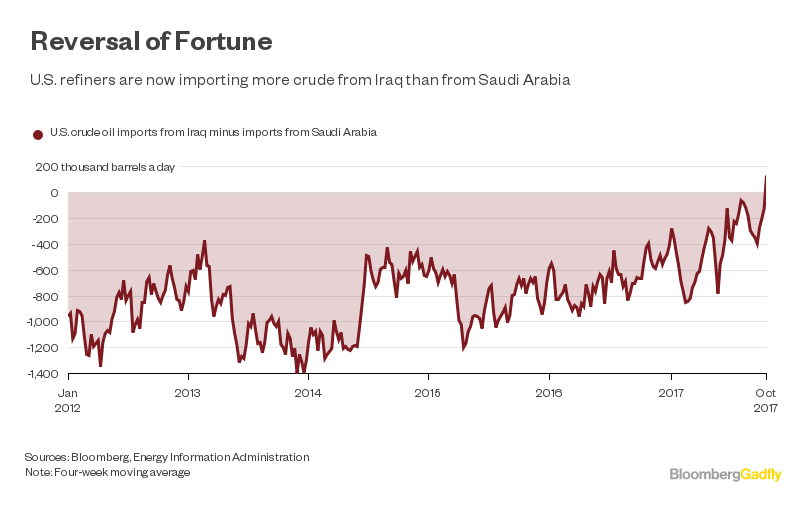

The net result of all this?

U.S. crude oil imports from Iraq have exceeded those from Saudi Arabia in 3 of the past 4 weeks. That would have seemed unthinkable as recently as last year. At that time, flows from Saudi Arabia were exceeding those from Iraq by somewhere between half and one million barrels a day.

It is easy to see this solely as the effect of OPEC output cuts and Saudi Arabia’s decision to target the highly visible U.S. market since June. But a look at the charts shows that the shift began well before the advent of OPEC’s current policy.

Part of the reason may lie in Iraq’s 2015 decision to split its exports into two distinct grades, based on the quality of its crude exports. The new Basrah Heavy grade is well suited to sophisticated U.S. refineries that can turn the thick, treacly crude into gasoline and diesel and it has found a ready market there. Saudi Arabia, in contrast, has focused exports on its lighter, more valuable grades, keeping the heavier ones to feed its own refineries.

As I wrote here Saudi Arabia is already losing market share to its supposed OPEC and non-OPEC partners in key oil markets in Asia, where it is seeing Iraq, Iran and Russia catching or passing its own sales. Now, it seems, its place in the U.S. market is also slipping away. Its fightback will almost certainly come — though it may be delayed until at least 2019, now that Crown Prince Mohammed bin Salman backed the extension of the group’s output cuts.

As for the U.S., it is now getting around a sixth of Iraq’s oil exports. Not enough for the president, perhaps, but it has the twin advantages of being legal and a lot cheaper in terms of both blood and treasure, than trying to “take” it.