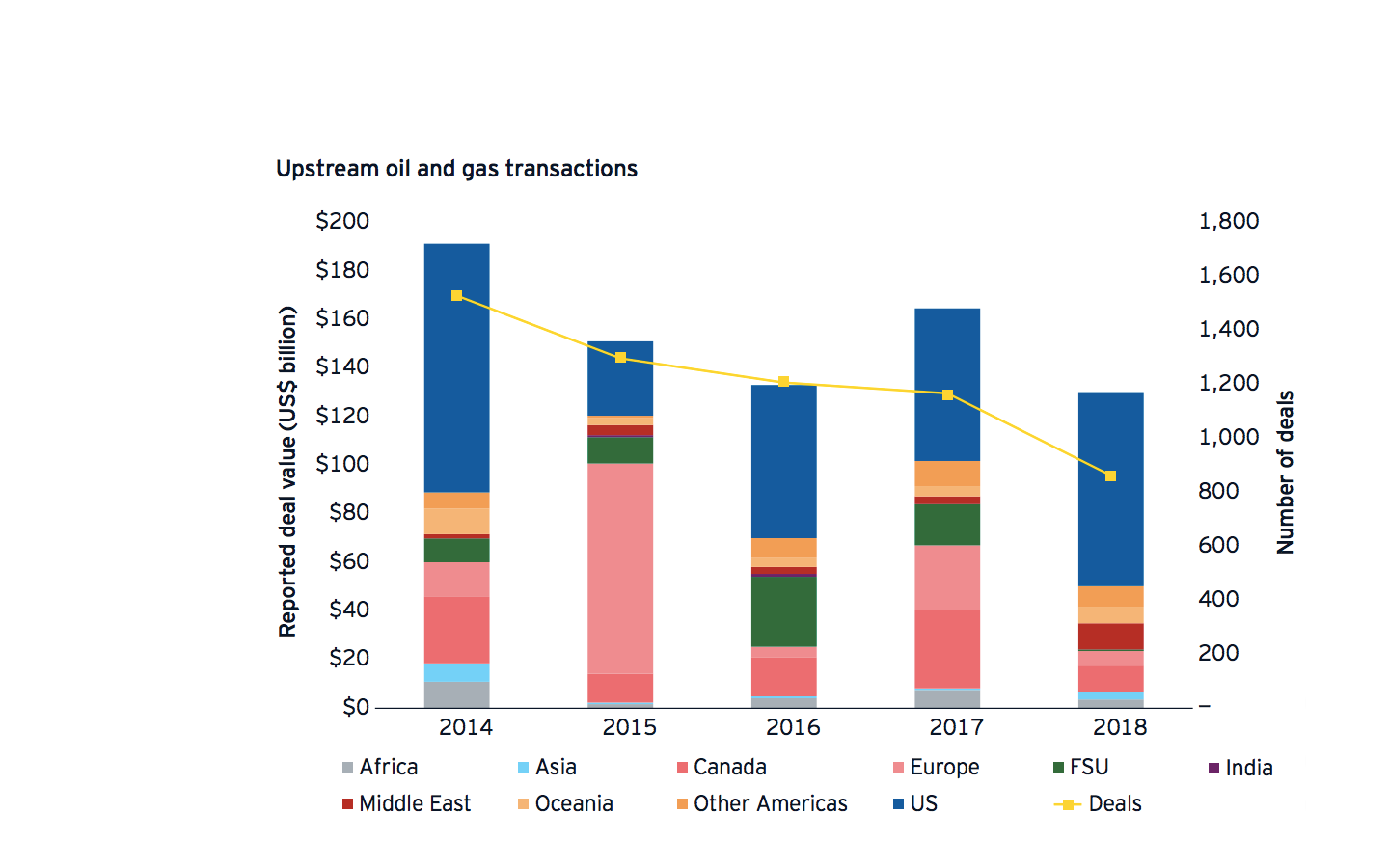

In the last year, mergers and acquisitions (M&A) activity in the oil & gas sector has shown continued hesitation from the heady days of $100 oil back in 2013. However acquisition activity is showing signs of gaining pace, and may become more aggressive than ever.

Credit: EY’s Global Oil & Gas transactions review 2018

Credit: EY’s Global Oil & Gas transactions review 2018

Innovation and new technology applications are being established as part of core business management tools and are starting to appear in the area of managing M&A. When M&A is announced, organisations are committing to buy an asset or asset groups – at which point a due diligence effort is usually conducted to establish the actual state of the asset.

Digital Twins have shown significant promise for the management of assets, and could also be transformational in the M&A process to qualify the quality of the assets.

A typical due diligence cycle takes six to nine months. In this timeframe, the buyers have a short period relative to the size and complexity of the acquisitions to correctly assess all the opportunities and risks. Asset evaluations can be quite circumspect; as the recent history of M&A in Upstream has more often than not demonstrated. Likewise during restructurings in the energy sector, the technical assessments and options considered are often very limited relative to the complexity and optionality available at the time of merger. Evaluation includes the inspection the asset(s)’s structural viability, liability, and estimated future performance.

Most of the time in the M&A process, the acquirer is faced with the choice of taking a calculated risk, or walking away from the opportunity. The question that decision makers typically ask themselves during M&A: are you confident in the asset’s structural integrity?

This is where a Digital Twin could bring added benefits, helping improve the quality of the business assumptions underlying the acquisition; including the asset life extension optionality, development or re-deployment options. In addition, the Digital Twin can give qualified risk assessment. Overall it improves the profitability of the deal and helps to de-risk the M&A process, removing doubt and reducing risk.

Within the time frame of a typical due diligence process, a physics-based Digital Twin can be created to offer a more controlled management of assets. Following the deal closure, the Digital Twin can play a key role in the forward operation, control and asset management; further lowering risk and improving performance for the asset. Digital Twins have also emerged as a key element needed to unlock the power of IIoT by enabling easier interpretation and empowering data-driven decision making.

Digital Twins allow engineers to monitor real-time analytics and test predictive maintenance to optimize asset performance, and also provide data that can be used to improve the physical product design throughout the product’s life cycle. If the asset(s) had a major incident during the transition to sale or restructuring, the Digital Twin can de-risk all of the issues giving the duty holder all of the necessary tools to safely manage and control the asset in a structured and controlled way.

This new information could feed into a business plan, improve management of acquisition, help in the identification of necessary repairs, as well as life extension options.

Today, a significant proportion of Assets world-wide are operating in a mature to late stage phase of their intended life and are facing Asset Life Extension or decommissioning. With a physics-based Digital Twin it’s possible to model various life extension options efficiently.

Creating a Digital Twin during the M&A process also means that its newly appointed operator will be starting with the ability to monitor analytics in real time, model various scenarios simultaneously and evaluate options to extend the asset lifecycle. Due to the combined advantages across the board, in the future, Digital Twins will become an integral part of the M&A process.

Recommended for you