The North Sea represents some of the best-in-class and most innovative work of the oil and gas industry. Here, significant progress in reducing gas flaring is already making a vital contribution towards delivering “net zero”, and Norway stands out as genuinely world-class.

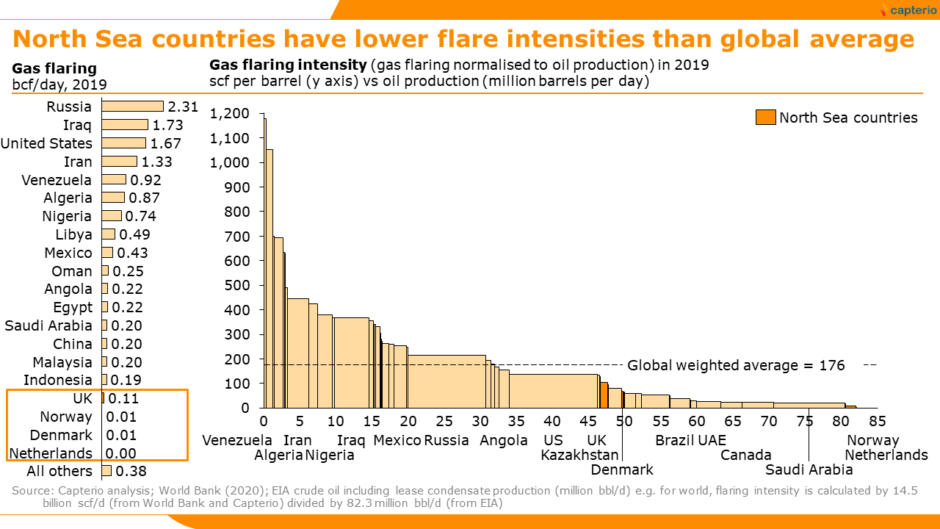

On both an absolute and relative basis, Norway has minimal flaring. The country’s “flaring intensity” – that is, flaring per barrel of oil produced – is industry-leading, at 9 scf per barrel. The North Sea weighted average intensity is also low, at 49, with the Netherlands at 20, Denmark at 66, and the UK at 105 scf/bbl respectively, according to Capterio analysis.

Each of these countries compares very favourably with not only the global average (176 scf/bbl), but also with major producers such as Venezuela, Algeria, and Iran.

Given the increasing focus on the ESG credentials of oil and gas operators, oil and gas operators must reduce the carbon intensity of their emissions. Beyond their obvious CO2 emissions, flares also release methane – a highly potent GHG – due to incomplete combustion at the flare tip. But there are other emissions sources too, including venting and leaking.

Competing

Low carbon intensity production is increasingly an area of competitive advantage for countries. As the energy transition accelerates, countries will increasingly focus on the carbon intensity of their imports. Countries and companies that supply gas with low life-cycle emissions will attract higher market shares or higher pricing.

Four key levers have enabled Norway to achieve such low flare volumes:

1. Effective policy. In 1971 Norway announced a total ban on non-emergency flaring in the Norwegian continental shelf. Its “zero flare” policy means that oil and gas developers are required to make gas utilisation plans before carrying out any field developments.

2. Well-developed infrastructure. The Norwegian gas pipeline network is expansive and can quickly – and at low cost – tie in associated gas from new developments.

3. Strong governance and transparency. Annual flare gas permits must be obtained from the regulator and these strictly limit flaring volumes and timing. Frequent inspections by the Norwegian Petroleum Directorate has led to a culture of transparency, measurement and reporting.

4. Innovative operating models. A single pipeline operating company (GassCo) runs the network and provides neutral and non-discriminatory third-party access.

Looking further

For the industry to maintain its social licence to operate, it needs to reduce its environmental footprint and align with net-zero across the globe.

The challenge is significant. Worldwide, flaring is back to levels not seen since 2009. Some 14.5 bcf of gas is flared today – the equivalent of Africa’s total gas consumption – yet to meet the IEA’s sustainable development scenarios, flaring must be reduced by more than 90% by 2025.

Responsible operators, with low flaring experience in places like the North Sea, have an opportunity to support flare reduction on a global level.

North Sea operators and regulators can help to reduce flaring worldwide in three ways.

Firstly, by continuing to reduce emissions and set the industry benchmark. Whilst flaring in the North Sea is already low, there is more work to do (and the total potential prize is enough to power more than 3 million homes).

Whilst retrofitting can be very costly, with the right fiscal and regulatory support proven solutions that reduce flaring – including gas reinjection, power generation and others – do exist and can be commercially attractive.

The UK’s Oil and Gas Authority’s (OGA) recent flaring report transparently discloses a wealth of flaring data is world-class and deserves particular praise. However, the UK could also join the World Bank’s Zero Routine Flaring initiative especially in the context of COP26. Other North Sea governments Norway, Netherlands, Denmark have taken this step.

Secondly, operators can spread the learnings beyond the basin. As North Sea operators and governments engage in other geographies, they need to support robust flaring policy and governance abroad, driving for zero flaring standards.

Lastly, they can invest in flare reduction beyond the North Sea. Flare gas capture projects are some of the most effective and attractive decarbonisation investments available globally. With substantial negative marginal abatement costs (up to $40 per tonne of CO2 abated), flare investments create value, reduce emissions (by up to 80%) and accelerate the energy transition.

The North Sea represents a best-in-class basin for dealing with flaring. Let’s share these lessons. Together we can continue to improve the industry’s ESG performance and social license to operate and play a leading role in the energy transition.

Recommended for you