With its prominence in the current news agenda there is no doubt that decommissioning in the North Sea has arrived.

Oil and Gas UK’s Decommissioning Insight Report 2019 suggests expenditure in the UK is currently running at £1.5 billion a year and that £15.2 bn will be spent on decommissioning assets on the UK Continental Shelf in the next decade.

Indeed, while the global decommissioning market has been valued at £67billion, some 43% of that expenditure will be in the North Sea basin.

A recent overview of UK North Sea decommissioning by global consultancy group Wood Mackenzie from January estimates 89% of operator capital spend will be on abandonment expenditure by 2029.

However, that timeframe could be shortened due to the impact of COVID-19, which has exacerbated existing low oil price challenges.

Such positive forecasts on decommissioning overall are mirrored by research acquired by Ardyne, the Aberdeen-headquartered fishing, milling and casing recovery leader, on the subsea well decommissioning market. This shows that the compound annual growth rate for the UK plug and abandonment (P&A) market grew by 25% from 2015 to 2019, representing significant opportunities for oilfield services companies in decommissioning.

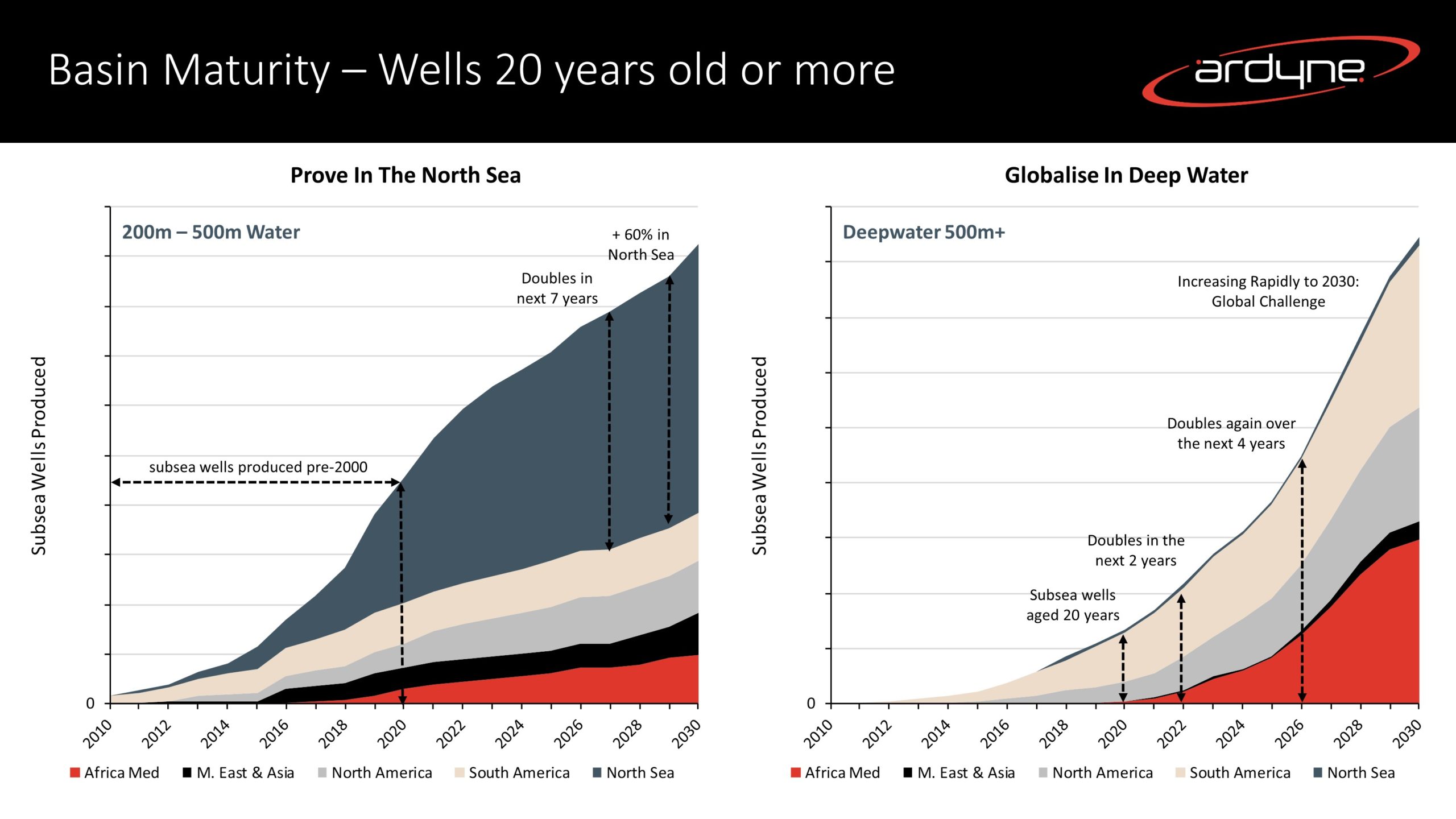

Further data suggests subsea well decommissioning in the North Sea and globally will be a huge growth area in future. Figure 1 shows that in water depths between 200m and 500m (typically the depths that would require a costly semi-submersible rig) North Sea subsea producing well stock is forecasted to rise rapidly to more than 60% of global stock by 2030. Added to this, when we consider that the growth in the global stock of deeper water aged subsea wells is also expected to rise markedly in the next 10 years, it is tempting to suggest the subsea well decommissioning supply chain could be facing significant challenges in meeting future demand.

While COVID-19 led to project delays across the industry this year, there are indications that 2021 will be better. As an example, in April Ardyne announced it had won four long-term contracts for work on 175 wells in the North Sea for fishing, P&A, inner string conductor recovery and slot recovery. After delays to the projects, Ardyne will be fully operational on three of those contracts before year end with the fourth expected to follow.

Aberdeen and North-east based companies have an excellent opportunity to steal a march on the world and make the most of local and global decommissioning opportunities. As the North Sea leads the way in decommissioning, innovative service companies are developing, manufacturing and commercialising tools in the UKCS that will be well placed to achieve industrial scale as the global market grows.

Ardyne, a market leader in technologies that reduce expensive rig time and risk, is an example of a company that started in the North Sea and has expanded to serve the global decommissioning market. The company’s TITAN single trip casing retrieval solution, developed in Aberdeen, saved an operator in the Gulf of Mexico approximately 90 hours of rig time on a well programme – at an estimated cost of £500,000 a day. Likewise, the ability of Ardyne’s technologies to save seven or eight hours per well on a 40 well project generates real value over the project scope.

Like a number of other service companies in the North-east, Ardyne fully understands the market that it plays in and does not intend to deviate from it.

Personally, I can appreciate why some companies diversify into other verticals or sectors, but it’s a bit like a dog suggesting it is going to become a cat. Ardyne sees plenty of opportunities ahead in its key markets and is happy to remain among the top dogs in what it does.

Many of the Ardyne team were involved in the North Sea’s construction, so we understand what is required in its dismantling and we recognise the importance and value of getting decommissioning right first time.

While I appreciate the buzzwords of collaboration, digitalisation and integration in our industry right now, Ardyne’s focus will always be on the basic challenge of fixing clients’ problems and bringing likeminded teams together to achieve that common goal.

It’s an approach that has worked in the North Sea since the 1970s and it will serve the decommissioning sector well as Aberdeen and the North-east becomes a centre of excellence so that others around the world can benefit in time.

Recommended for you