The past 15 months or so have been difficult for many industry sectors – and energy has been no exception.

Over the next 12 months, the industry globally will certainly face continued uncertainty, with challenges in predicting the speed of recovery to the next ‘normal’ economy, and differences by region.

Despite this, and at least in part because of it, the ongoing drive to sustainability undertaken by many of the leading global enterprises across the sector will continue as energy businesses must find ways of becoming greener and more efficient and profitable at the same time. They must satisfy financial markets, shareholders, employees and customers.

Societal lockdowns acted as a catalyst. As people were forced to stop driving or flying, carbon emissions fell, as did demand for transportation fuels. With the evidence that people’s behaviour can palpably impact global CO2 loading, corporate momentum, across the energy sector shifted perceptibly towards more aggressive sustainability targets.

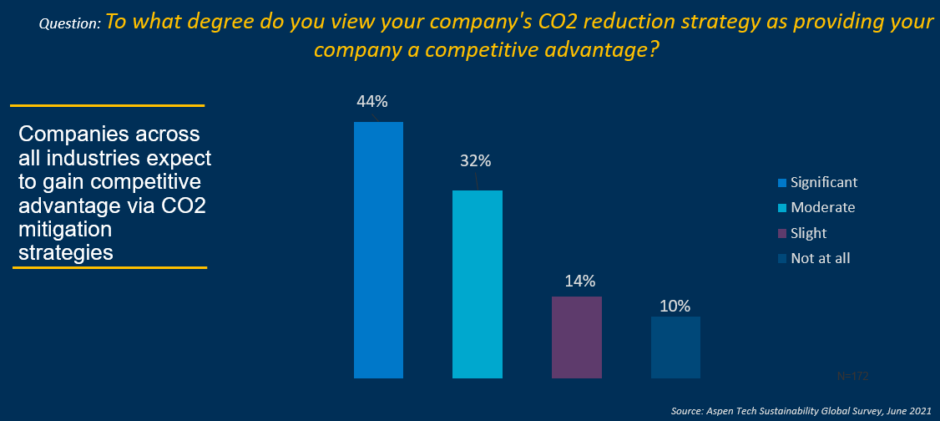

Now the challenge is to meet those targets. A survey we just completed in June 2021, shows how executives view the criticality of this to maintain competitive advantage:

Predictions and projections

This renewed focus on sustainability has resulted in many organisations ramping up their digital transformation efforts as they look to drive efficiencies and achieve their corporate objectives.

A survey of 186 companies completed in December 2020, by Crystol Energy and AspenTech highlighted digitalisation and other new technologies increasing by 14 percentage points, ranking it as extremely important or very important post-COVID, compared to those ranking it as such as a pre-COVID priority.

Digitalisation is a critical tool for companies as they respond to the pressures from shareholders, consumers, communities and employees to address the challenges of sustainability.

We are seeing more money going into digitalisation initiatives and we expect the pace of this investment to continue to pick up over time as the key trends of sustainability and digitalisation continue to operate in tandem.

Certainly, we would anticipate the ongoing focus on digitalisation to be maintained. Energy companies globally accelerated their digitalisation programs over the past year in response to economic and energy market shocks.

The top digital sustainability “apps” areas include improved ability to track carbon across facilities and assets, innovation platforms to accelerate energy transition, and resource optimisation. We expect that the focus and scope of digitalisation over the next year will at least increase.

In line with digitalisation, the rapid pace of technology innovation more generally will most likely continue to accelerate over the course of the next 12 months.

Some of it will be applied to support the growth expected through economic recovery, already being seen in the US, China and in other parts of Asia, and expected in many other regions globally through the next year.

Some will be applied to shifting supply chains and increasing resiliency – and some of course will be applied to achieving sustainability goals.

A more sustainable future

In line with this sustainability focus, we are also seeing a continued and concentrated focus on energy efficiency in refining, LNG and midstream. This is something that makes complete sense in the current environment because it both reduces operating cost and also carbon footprint.

Improving energy efficiency can also have the biggest impact on most companies’ sustainability metrics. If you reduce your energy use, you increase your profitability. It’s a net-net positive.

In our survey, 76% of companies say they are focused on energy efficiency today.

We also expect to see continued progress on carbon reduction as the largest energy players in Asia and North America start to closely follow the “early movers” in Europe and the Middle East to explore and “prove out” the most promising technology approaches to carbon capture and carbon reduction in the energy value chain.

There are strong signs of a drive towards new energy sources and new materials. The hydrogen economy is enjoying renewed focus and excitement despite the many economic and technical challenges still in front of commercialisation of hydrogen-fuelled power and mobility.

Our survey shows that over half of companies will be engaged in hydrogen energy and in carbon capture over the next five years.

We are also seeing a shift in the production mix in refining, which is set to drive further efficiencies across the energy sector. Part of this is towards chemicals feedstocks.

As economies and middle-class growth both regain momentum, projects such as the proposed Indian RRPCL mega project integrating refining and chemicals, make sense to meet growing and shifting market demand.

At the same time, there is a continued evolution from oil to gas, especially with respect to chemical feedstocks and power generation.

Electrical demand will continue to grow, and natural gas will fulfil a crucial need here.

In line with all this, there are signs of a transition to more sustainable chemical production. The societal drive towards reduction in wastes in general, and plastic wastes in particular, will drive integrated producers and chemical producers to continue to innovate and invest in this area.

As the world recovers from the COVID-19 pandemic, the energy industry looks set to continue down the path towards sustainability; to reducing the environmental impact of its activities and to facilitating energy transition.

Beyond this, as the industry undertakes its journey it seems certain that the digitalisation of systems and processes will provide the mechanism for turning sustainability objectives into fully realised goals.

Recommended for you