The UK North Sea saw little bounce back in activity following the 2020-21 ‘Covid low’, with only the M&A space staying buoyant.

New project approvals, start-ups and E&A drilling, remained low. Four of the five fields that did come online, comprising Tolmount, Blythe, Elgood and Abigail, saw varying levels of downgrades post-start-up.

Exploration delivered confirmed discoveries at North Eigg and Dunnottar, but with both being borderline commercial new viable volumes remain scarce.

Despite the Energy Profits Levy (EPL) dampening the enthusiasm of some companies (such as Harbour), the 33rd Licensing Round, the first for nearly three years, is expected to see strong appetite.

Particularly from those E&Ps with hubs where production cessation is looming, where near-field drilling could delay abandonment.

The introduction, and subsequent increase in the EPL, was the biggest change to the upstream sector during the year.

For some companies with large imminent capex, such as Equinor at Rosebank, the opportunity to offset the EPL means the impact could be positive, promoting timely investment.

But for many, particularly those with high production volumes and few material capex opportunities, it was a significant blow.

Furthermore, with large greenfield developments lacking on the UCKS, there are few opportunities to acquire such assets, either through licensing or M&A.

Ultimately, the Chancellor’s gamble of a short-term boost to the country’s coffers decreased fiscal stability and has risked longer term upstream investment by many E&Ps.

This includes those E&P companies with plans for spend in the energy transition space, whose investment may now be in jeopardy if their upstream cash flow which supported such projects is threatened.

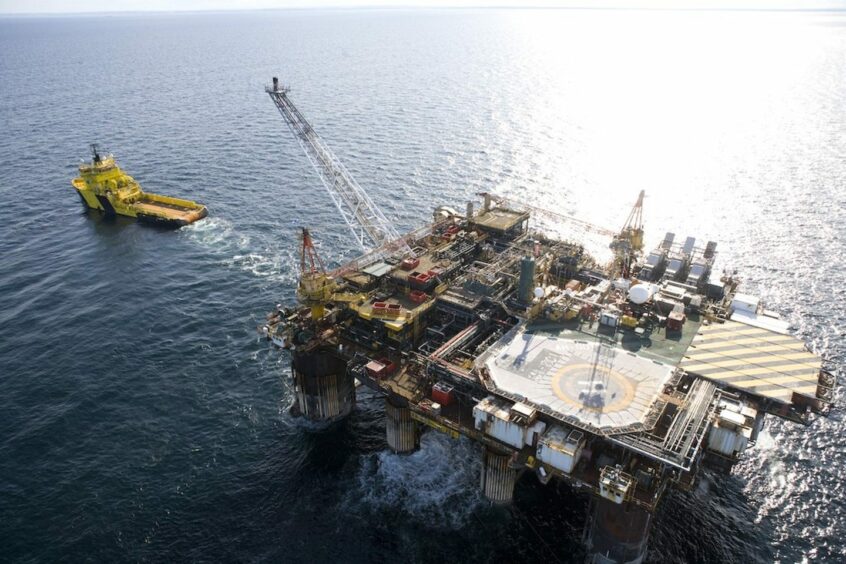

Three things to watch for in 2023. The firming up of plans for electrification of offshore facilities – in December the signing of an MoU by BP, Equinor and Ithaca regarding electrification in the West of Shetlands was encouraging.

Electrification of assets may now be more attractive post-EPL for companies seeking capex opportunities, especially as upstream decarbonisation is not subject to the reduced investment allowance.

Secondly, further progress at the few remaining large greenfield developments, including Cambo, Rosebank and Jackdaw, is also expected. And thirdly, the large pool of opportunities, including CNOOC, ONE-Dyas and Suncor, along with Shell and ExxonMobil’s SNS assets, means M&A activity is set to remain buoyant, provided there is appetite by buyers. And a possible, but optimistic, fourth – the introduction of some form of an EPL ‘off switch’, that would be triggered by an oil price floor.

Recommended for you