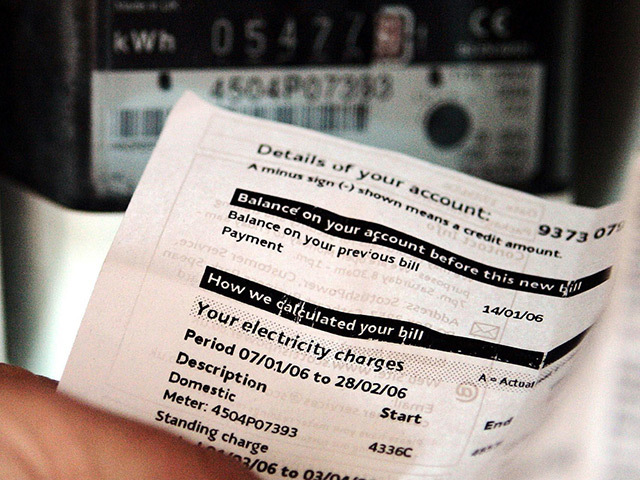

Most of the big six energy companies have announced annual gas and electricity price increases of about 10%, which have been met by understandable outrage.

The current rate of general inflation (consumer price inflation, CPI) is 2.7%. Average earnings have increased by about 1% per year so most of us are worse off, even excluding the energy bills which now average about £1,300 per year.

Why should energy bills increase at three or four times the inflation rate?

I am writing this column before representatives of the big six companies appear before the House of Commons Energy Committee, so I obviously do not know what will be said then. However, they have received a torrent of abuse in the last few weeks from a bizarre alliance of people such as Sir John Major and Ed Miliband.

Official statistics from the Department of Energy and Climate Change (DECC) show that about 47% of the annual £1,300 bill is accounted for by wholesale energy costs; 20% by network costs – that is distribution and supply; 13% “other supplier costs”; 9% government policies for renewable energy and improving energy efficiency; 5% VAT; leaving 6% profits.

A 6% profit margin is low. However, it is very misleading because more profits are made from wholesale energy prices than the retail prices you and I pay.

Most – but not all – of the big six companies are vertically integrated. They produce their own gas and/or electricity; and they have separate retail divisions to which they sell their “wholesale” energy.

They can therefore make profits from both their wholesale and retail operations but obviously prefer to concentrate public attention on the allegedly 6% retail profit margin.

Most of us consumers now use just electricity and gas for our domestic energy. There are, however, folk who farm or live in remote communities who have to use coal or oil, mainly because mains gas is not available though there is the expensive alternative of bottled gas.

Wholesale electricity costs are difficult to assess because of the mix of generating capacity in Scotland, including the nuclear power stations at Hunterston and Torness, coal at Longannet and gas at Peterhead, sundry hydro-schemes, plus the rapidly increasing number of windfarms.

The Scottish Government is very committed to renewable energy. I have written before that the subsidies for onshore windfarms are much too high but they only account for a small proportion of the latest price increases.

It is much easier to get information on wholesale gas prices, which have risen by about 2% a year over the last few years, and this is obviously much less than the repetitive 10% or thereabouts year-on-year increases in our energy bills. How therefore can the big six companies justify that difference?

UKCS gas production is declining at about 15% per year. That is one of the reasons for the recent problems at the Grangemouth petrochemicals complex.

Declining production usually means higher unit costs. However, the worldwide gas industry has been transformed in recent years by two factors: the growth in liquefied natural gas (LNG) trade and the shale gas revolution in the US.

There has been a big increase in world gas production in recent years, mainly because of investments in LNG export and import terminals. We do not have any LNG terminals in Scotland but there are new ones in Wales and England, which have contributed to a large fall in wholesale gas prices in Europe, including the UK.

Rising domestic shale gas production has resulted in even larger falls in gas prices in North America. That should also have a downward impact on worldwide gas prices, although it might take a year or two more for that to work its way through.

I therefore do not believe that the latest retail price increases are justified. Some of the companies have argued that the daily – or spot – gas and electricity prices can be misleading because they have agreed long term contracts. Others hedge prices.

Nevertheless, for the vertically integrated companies such as British Gas that should make little difference. Upstream and downstream profits can be added together at the end of the day.

The gas and electricity markets are regulated by Ofgem, primarily to protect consumers from the negative effects of monopolies. However, the big six companies seem to be operating like an oligopoly – in the economics jargon – which seems to be no different from a monopoly. Wholesale gas prices have risen by less than 2% over the last year but retail prices are being jacked up by up to 10%.

I believe that Ofgem needs to be much more assertive in protecting consumers from these unjustified price rises. Red Ed and Sir John have made their points well but we really need somebody to take action.

Tony Mackay is MD of economists Mackay Consultants

Recommended for you