A 2020 study by McKinsey stated, ‘The oil and gas industry accounts for 42% of global emissions…in addition, it produces the fuels that create another 33% of global emissions.’

This realisation led to an upturn in energy transition activity, and an outflow of resources and funding from traditional oil and gas (O&G) activity to more sustainable projects.

However, O&G still remains a key source of energy in the meantime, and capital is still being allocated to it, as evidenced by the green light given to the Rosebank oil field in northern Scotland.

Considering the O&G sector has historically seen a low level of participation from private equity (1% of all PE deal activity in Europe has been O&G related since 2022), will large investments like Rosebank draw in PE participation?

The short answer is yes, but only in parts.

Navigating variations in investment appetite and matching your niche

PE investors are typically drawn to high margins, strong recurring revenues and good growth prospects.

They tend to avoid companies with high capex requirements.

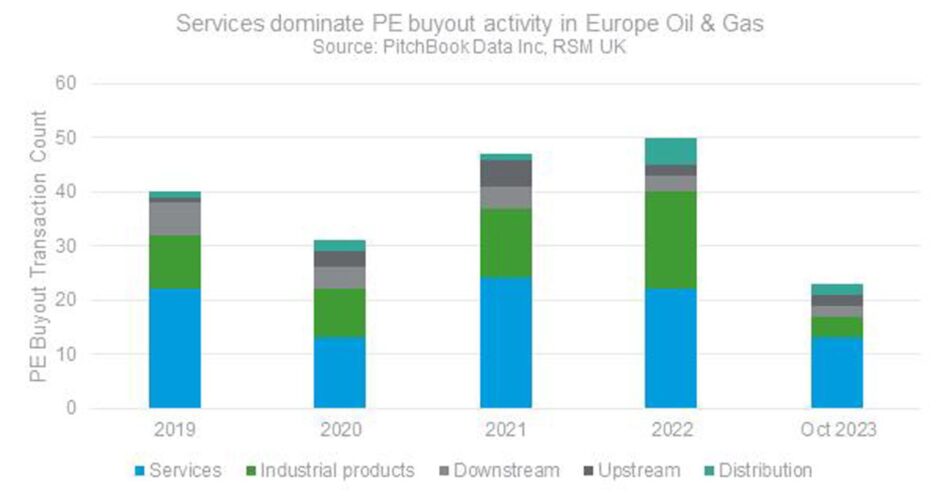

Hence, when drawn to the O&G space, they are attracted to the services part of the value chain as shown in the graph below.

This aligns with PE activity more generally, where commercial services is the most active sector, accounting for a quarter of all UK deal flow since 2021.

There are large variations in the 350 UK-focused PE firms that RSM profiles the investment appetite of.

This can make it tricky for companies raising capital, because subtleties of the investment proposition will interest or disinterest investors, and its especially difficult for O&G sector companies who need to pass the increasingly important ESG filter that PE is applying to its investments.

Private equity seeks transition opportunities

Services aimed at making projects like Rosebank a success with as little environmental consequence as possible, and/or those enabling the transition away from the carbon economy eg those reskilling workers, will be particularly attractive.

To emphasise the point, dedicated PE impact funds have been launched that are specifically aimed at companies making a positive impact on the environment and society.

While it seems logical that companies could successfully transition under PE ownership from being carbon-centric to becoming green assets, we are not aware of companies that have successfully transitioned in this way – yet.

However, by combining PE’s strategic and operational expertise to transform businesses, an interest in making a positive ESG contribution, and an appetite for add-on acquisitions that can fast track transitions, we predict there will be PE investors that will back this path in the future.

Overall, a project like Rosebank will spur on economic activity in the region and the prospects of PE-backed businesses, but the main opportunity for PE will lie in services, especially for those businesses that enable the ESG agenda.

Recommended for you

© ROVOP

© ROVOP © Supplied by RSM UK

© Supplied by RSM UK © Supplied by RSM UK

© Supplied by RSM UK