Covid-19 visibly and drastically altered the way we in the energy industry work and communicate with one another. Many regions are still in the early phases of a long recovery, but if we examine the fuller picture there are common themes emerging that are impossible to ignore, unlikely to disappear and are worth reflection.

A variety of global shocks have forced governments to rethink their external, long-term energy supply strategies, with much of the focus now on security of energy supply and In-Country Value (ICV). It is only natural that in the wake of a pandemic that caused much of the world to grind to a halt, people will question the apparent benefits of globalization. Governments have responded by focussing on the renationalization, or at least a regionalization, of the energy supply chain, underpinned by initiatives like local content targets. We carry out a lot of work in the Middle East where ICV is an established concept, but it seems that this concept is taking hold in more mature economies. As American industrialist and businessman Henry Ford famously said, “anyone who keeps learning stays young”.

For the energy supply chain, this macro shift in focus presented another chance for it to demonstrate its laudable adaptability. As Covid made its way around the globe we saw the supply chain switch its way of working, almost literally, overnight. Take the example of remote inspections, which quickly became the norm because there simply was no choice. We have been suggesting clients to consider this prior to Covid with some success but post pandemic there has been a general return to the old ways of working, with boots on the ground. Beyond adaptability, the energy sector showed its “elasticity”! This tendency to revert to the norm is understandable, but as an industry we must try to seize opportunities when they arise. Necessity still beats efficiency when it comes to driving change.

A healthy, functioning and diverse energy supply chain is of benefit to the entire sector and even more importantly to a developing a flourishing renewables industry. Fostering this fundamental part of the industry requires clarity and commitment from all sides. Nobody is oblivious to the potential challenges and crunches that remain, a fact borne out in the findings of DNV’s latest Energy Transition Outlook report, which flagged several current and impending bottlenecks that threaten to slow our move to net zero. Smoothing these kinks out requires further investment and planning on all levels. While COP28 is ongoing, the energy supply chain will require more than “uncommitting” commitment.

When trying to determine the impact of events as seismic as Covid there is a phrase that often crops up – the acceleration of history. Crucial moments in time that alter how we live. In an energy sense, the pandemic sparked something of an awakening; it caused businesses to consider their reason for being, their core areas, their established models or maybe even another type of ICV; In Company Value. Much of the sector is still in thinking mode coming to terms with what these questions means for them; soon they will need to be in action mode – then we will be in a position to truly assess the lasting impacts of the pandemic on the supply chain.

Supply chain companies can emerge from global shocks all the stronger and in a better position to combat future challenges. Many firms are still having to work with tighter finances and the current stresses of global inflation are inescapable. Suppliers’ ability to pass their

increasing costs onto their customers depends largely on their place in the chain; the higher they are, the more influence they have.

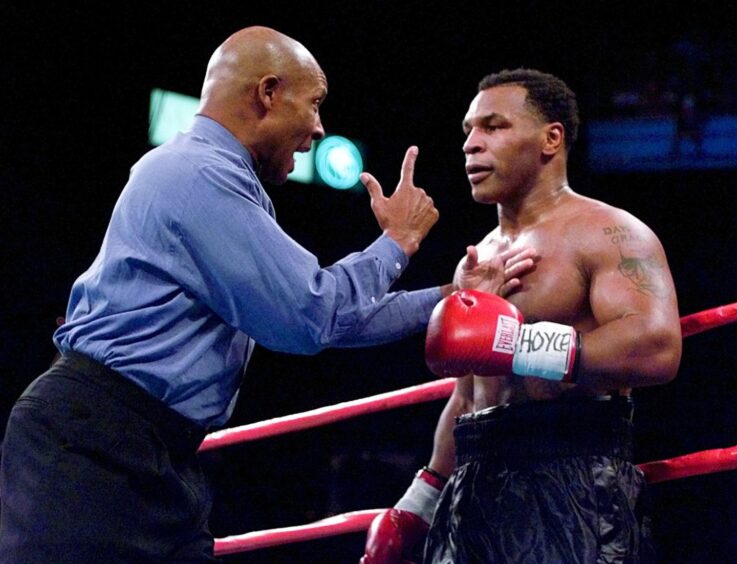

Irrespective of size and stature, all supply chain companies should nurture their inner stoicism by controlling the controllable. Resilience and strategy planning are key parts of any business and the last few years have clearly demonstrated why. However, ‘everyone has a plan until they get punched in the mouth’, to coin Mike Tyson, and rolling with the punches is easier if you’re agile and prepared to change. This is directly linked to a company’s culture and the tone for that needs to come from the top, tone, being possibly the only raison d’etre of leaders.

Recommended for you

© Supplied by DNV

© Supplied by DNV