The UK can unlock significant future growth opportunities in offshore wind – but only if industry and government work collaboratively to support a positive investment climate.

Over the past decade, the UK has been a global leader in the rollout of renewables, especially in offshore wind, boasting the second-highest built capacity (14GW) after China.

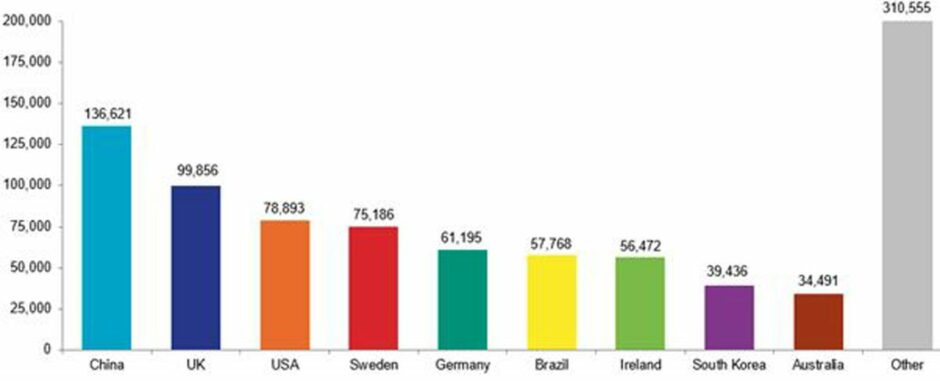

However, to date, much of the economic benefit from this has gone overseas due to an underdeveloped domestic UK supply chain.

Many of the companies along the offshore wind value chain are located outside of the UK, from those that manufacture the wind turbine turrets, blades and power-generative components, to providers of heavy-lift and support vessels, and of course the wind farm developers themselves.

Developing a reliable and resilient supply chain is now a global competition as more countries embrace offshore wind and other offshore clean energy solutions, such as the generation of green hydrogen from offshore wind.

The opportunities are vast with RenewableUK estimating that £8 trillion will be spent on global offshore wind by 2050, leading to a potential £1 trillion export market for services by 2035.

The UK’s ‘many advantages’ in wind

The UK is endowed with many advantages which it should leverage, from a long heritage of precision manufacturing and innovation to the specialist technical expertise to manage complex offshore energy projects.

The relatively shallow waters of the North Sea and strong prevailing winds, together with a mature offshore oil and gas supply chain, have provided an ideal setting for an offshore energy revolution.

These natural advantages provide the ingredients to develop a new thriving industrial ecosystem to service current and emerging renewables technologies, and to export these services around the world.

RenewableUK’s new Industrial Growth Plan (IGP) for offshore wind published mid-April charts a course for the UK to become a global leader and to benefit from significant growth opportunities.

The IGP identifies five key areas where the UK holds a competitive advantage with existing capabilities: advanced turbine technology, foundations and substructures, next generation electrical systems, smart environmental surveying, and next generation installation, operations and maintenance (O&M).

A strong UK-based supply chain, capable of competing with European giants and offering end-to-end services across the entire offshore wind lifecycle, will bring with it enormous economic benefits.

It will also strengthen the UK’s ability to achieve its ambitious 2050, and nearer term net zero targets.

Supply chain support is needed now!

The time to support the UK’s renewable supply chain is now – with a holistic strategy that covers raw materials, manufacturing, infrastructure and appropriate support mechanisms for renewable development projects.

The IGP offers a detailed roadmap for achieving this vision, but a key question remains as to how to lower investment risk for UK supply chain companies to give them the confidence to make the necessary investments for long-term success.

To encourage the investment required to develop a reliable and resilient UK supply chain, two potential solutions are: the incentivising of long-term contracts aimed at giving the whole supply value chain a long investment horizon and opening up access to affordable capital.

Following a model that has been successful in the Norwegian oil and gas sector, offshore wind farm developers could be incentivised to favour offering long-term contracts for suppliers.

This would mean offering contracts for their multi-project portfolios that run for over a decade compared to single projects that are limited to a couple of years.

This longer investment horizon reduces the risk of investment into the resources and capabilities that are currently lacking in the UK’s manufacturing, infrastructure and services sectors.

The supply chain’s offshore wind ‘obstacle’

Access to low-cost capital remains an obstacle, especially in a higher interest environment, and one option would be to provide greater access for companies that are within or utilise the UK’s domestic supply chain to infrastructure grade lending, such as the funds set aside in the UK infrastructure Bank.

Rewarding companies that are investing and contributing to the growth in green jobs, greater domestic supply chain content and accelerating the goal of a responsible energy transition for the UK seems like a sensible incentive that will be to the benefit of all stakeholders.

The construction and operation of a wind farm requires multiple specialist subsea, topside and marine services.

To further reduce costs for wind farm developers, and ultimately consumers, there should be a greater move toward the utilisation of integrated contracts, where a single provider delivers multiple services.

Using oil and gas experience

At OEG Renewables (OEGR), where I am the Chief Commercial Officer, we are a leader in the UK and globally in combining subsea, topside and marine services to create a greater value proposition for our customers.

OEGR has a 50-year heritage with deep industry expertise honed from supporting the oil and gas industry and is now leveraging this experience to support the offshore wind sector.

The result is that OEGR, having worked on the majority of major offshore wind developments in the UK and internationally in the past couple of years, are fully aligned with our wind farm developer customers to achieve their project goals and this deeper relationship means greater certainty and confidence to invest in our business.

By implementing these recommendations, the UK can solidify its position as a global leader in the offshore wind industry.

This is a critical issue for the next UK government, which must act decisively and quickly to ensure investment now in our renewables supply chain so that it is primed to unlock the immense growth opportunities that are available.

Through collaboration government and industry can lower investment risk and build a domestic supply chain that is resilient and capable of maximising the economic and environmental benefits, from jobs to exports, as well as achieving a responsible energy transition while meeting net zero targets.

Recommended for you

© Supplied by RenewableUK

© Supplied by RenewableUK © Supplied by SEAJET

© Supplied by SEAJET © Supplied by OEG

© Supplied by OEG