The events of 2014 have demonstrated just how quickly political and economic risks can escalate and shift into large-scale crises, even in historically stable countries.

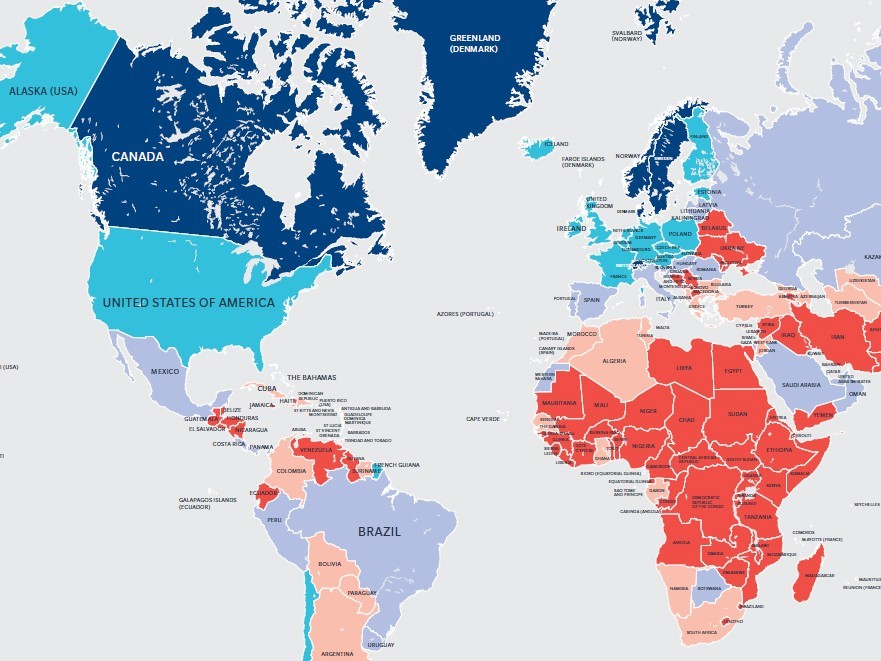

As we move into 2015, the biggest sources of uncertainty for many energy firms will be volatile commodity prices and political risk. That’s reflected in our Political Risk Map, produced with Business Monitor International (BMI), which details overall risk scores for 185 countries based on three categories: political, macroeconomic, and operational risk.

Falling oil prices will undoubtedly be the biggest concern for oil and gas companies. In the last five months, we’ve seen the price of Brent Crude drop from more than $100 boe to around $60, a reduction of more than 40%.

While the operational and financial ramifications of this are obvious, the political consequences are less well-understood. Principally, a prolonged period of lower prices will likely have a negative impact on countries which are net oil exporters.

In countries such as Venezuela, where oil accounts for 95% of exports and more than half of government revenues, this could precipitate civil unrest and significant political changes. Similarly, in Iran the deteriorating economy could undermine support for its moderate government and accelerate currency devaluation.

Other oil-producing countries such as Angola, Gabon, and Nigeria are at high or severe risk according to BMI and our analysis.

Oil and gas firms with operations in these countries would do well to analyse the extent of their risk exposure. Not only should they be looking at what the consequences could mean for their own businesses, but also the likely impact on their customers and suppliers.

Cyber attacks pose a real and increasing threat to energy firms. These forms of attack tend to come from organised criminals and other private actors. The oil and gas sector has increasingly become a target, resulting in delays to production and potential damage to infrastructure.

The energy sector should look at ways of mitigating this risk, including insurance which can assist with incident management and can provide protection against losses. While many insurance policies contain cyber-attack exclusions which can leave businesses exposed, insurers are reacting to market pressure from clients and their brokers alike, and are introducing more comprehensive cyber insurance products.

There are other factors to consider too, ranging from economic sanctions against Russia following its intervention in Ukraine, to the growing potency of social media – demonstrated by the Arab Spring back in 2011. That has led some countries, including China, Iran, and Turkey to restrict internet access for their citizens in the last 12 months.

Whatever the case, we have an interesting year ahead of us. Oil and gas firms with international operations should prepare themselves for anything – because as the last 12 months has shown, anything can happen.

Andrew Herring is the Practice Leader for Marsh’s Energy for the Europe, Middle East and Africa (EMEA) region. Andrew joined Marsh in 2010 as a Managing Director responsible for the Americas before taking the role as Energy Practice Leader for the EMEA region in 2012.

For more from our Energy Voice columnists click here.

Recommended for you