And the reason for why is classic … construction delays in Asia-Pac yards, in this case Daewoo (DSME) of South Korea.

The yard bagged the $1.76billion Mariner topsides back in 2012. Sailaway was supposed to be in early 2016, now it’s retimed to 2017. That’s five years!

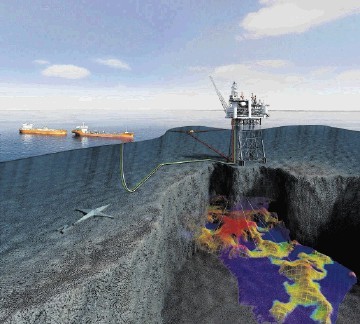

For goodness sake, BP found Forties in late 1970 and had the field onstream by November 1975 … just six years. Pretty much everything was built in Europe – mostly UK – by a fabrication industry straight out of nappies. And Forties is still going strong (See Energy next Monday – Nov 2).

Time and again, North Sea oil & gas projects have fallen foul of construction delays in the now not so cheap Asia-Pac yards. Not only that, there have often been major quality issues, resulting in time consuming and expensive remedial work back here in Europe before deployment.

And if you don’t believe me, then how’s about this for a piece of news. It broke earlier this month.

South Korea’s majors rig builders Hyundai Heavy Industries (HHI), Samsung Heavy Industries (SHI) and Daewoo Shipbuilding and Marine Engineering (DSME) have teamed up in a joint industry project, looking to cut rig construction costs and project delays.

Yes, things are so bad out there that they’ve decided to bang their heads together proactively.

According to HHI, the three companies recently held a meeting for an “Offshore Design Standardization JIP” with American Bureau of Shipping (ABS) at Houston, Texas. And similar meetings have already been held with DNV GL. The plan is to further expand the standardisation work with Lloyd’s Register and Bureau Veritas, and to list the common rules on ISO.

Leaving standardisation side, I contend that the yards should not be accepting work if they cannot deliver on time. Fat order-books are a matter of pride; but not if they result in heavy delays and cost-overruns.

That said, the North Sea operators placing the orders need to be clear what it is that they are buying and not mess the yards about.

And they should pay a great deal more attention to the still significant offshore fabrication capability that exists in Europe. Yes, they get some of the work, but nowhere near enough, IMO.