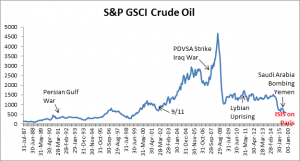

Geopolitical developments often have a major impact on oil prices since they can affect oil supply directly and since the threat of future supply disruptions can also build a risk premium into oil prices. As a notable example, in the early part of 2014, conflicts in Libya and Iraq led to temporary outages in their oil production, keeping world prices high, even as supply elsewhere in the world continued to ramp up. When production from those two countries came back on stream, that was an important trigger for the plunge in oil prices later in the year. Notice how much oil price spiked at the historical times of war.

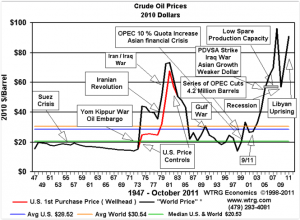

While the S&P GSCI Crude Oil only is recorded since 1987, below is a chart that goes back to 1947 by WTRG Economics that shows spikes in oil price jumped more than 2 times on average during critical periods of conflict, including the Iran/Iraq War, Iranian Revolution, Yom Kippur War and Oil Embargo.

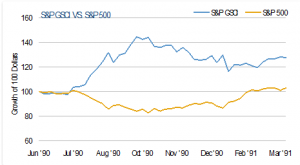

Generally, when there is a war, commodities perform well since it takes resources to fight a war and people will continue to drink coffee and eat cereal, which is the kind of fundamental economic diversification that makes this asset class important. For example, below is a graph of the S&P 500® versus the S&P GSCI® during the Persian Gulf War that shows while stocks dropped, commodities rose.

In the recent environment, OPEC is committed to maintaining market share in the global oil markets. Shortly after the natural gas deal was signed between Russia and China, OPEC started flooding the market with oil to drop the price so marginal producers exited. This also happened in the 1986 period when OPEC dropped the price from $32/bbl to $10/bbl which may have led to the breakup of the Soviet Union. The current low oi price has divided the world by importers, exporters, developed and emerging markets

Now, just as the world is agreeing on a chance for structural reform, the picture may change again. The ISIS attack on Paris might be the catalyst to change OPEC’s oil market policy of defending market share. Saudi Arabia may need to alter their focus to support defensive measures rather than maintaining oil market share. There is a pivotal question about whether Saudi protects the long-term value of oil reserves or if they defend their role as the pre-eminent Sunni power in the region… both are important.

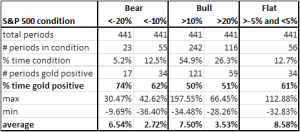

On a different note, the other major commodity associated with war is gold, as it is known for its role as a safe haven in times of market crises. Using rolling 12-month returns (monthly year-over-year) from Jan 1979 – Sep 2015 of the S&P 500, the result shows that whether there was a bull, bear or flat stock market, gold was positive at least half the time. The stock market condition didn’t necessarily say anything about gold returns, but gold performed well when there were bear market conditions. It was positive the highest percentage of the time, 74%, in bear markets that lost more than 20%, and on average gold gained 6.5% historically in this condition.

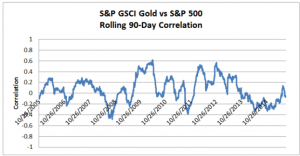

Since most single factors like inflation, interest rates, jewelry demand, oil prices, geopolitics and U.S. dollar strength don’t alone move gold, they are unreliable indicators of gold’s prices. However, one statistic that is pretty solid through time is that gold is uncorrelated to the stock market. On average, the 12- month correlation is zero but even on short intervals of rolling 90 days the correlation doesn’t ever exceed 0.6.

Based on this, the case can be made that gold has protected in down markets and has been a good diversifier.

In conclusion, despite the tragedy of the attack on Paris, commodities may help investors diversify through this difficult time. Oil prices have historically spiked in times of crisis, and with the production dilemma on the table for OPEC, Saudi may need to reallocate resources to national defense. There may be a demand reduction from the crisis but not enough to offset supply issues. This holds true for agriculture and livestock as well, that are more highly impacted by weather and may benefit from El Niño in the near future. Additionally, gold may also hold its role as a diversifier as it has in the past during stock market crises.

Jodie Gunzberg is the Head of Commodities at S&P Dow Jones Indices.

Recommended for you