Mathios Rigas isn’t afraid of a stacked deck.

He doesn’t flinch when the odds are so glaringly against him even the dealer thinks he should cut his losses and run.

Mathios Rigas isn’t afraid of a stacked deck, because he once took that bet and lived to tell the tale.

In 2007, the industry entrepreneur was approached to takeover a firm.

This was the hopeful company’s pitch.

It had a negative EBITDA of €30million.

It owed the Greek government €80million.

Its daily production barely reached 800 barrels and its exploration licences were due to expire in just three months.

Finally, all of the firm’s assets were located in Greece, a country with very little space on the international oil and gas stage.

“It was a disaster waiting to happen,” Mathios said.

“There were 400 people that were going to lose their jobs and that would have created a very serious situation in Kavala.”

Mathios, a native Greek, soon agreed to the takeover, acquiring all of Eurotech shares from Regal Petroleum, 66.6% of Kavala Oil’s common shares and 95% of Kavala Oil’s preference shares.

He pumped €180million into the once failing firm, now known as Energean Oil and Gas, and built a much more persuasive pitch.

The firm now averages more than 2,000 barrels a day, has a 25 year production licence and boasts an infrastructure capable of supporting a total capacity of 30,000 barrels a day.

“The proposition was a huge bet, but I believed in the assets and saw the potential to produce more oil. I saw it as a unique opportunity,” Mathios said.

One of chief executive’s first big purchases was to acquire four jack-up rigs to leverage possible returns.

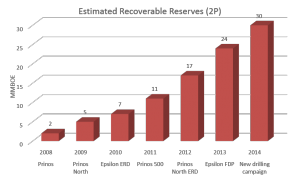

For Mathios, the Prinos basin’s total potential includes 30 million barrels of proven and probable reserves. The big ticket number tallies up to $1billion, according to an independent evaluation he quoted.

And he wasn’t the only expert to see an emerging spark in Greece’s offshore potential.

Mathios soon struck a six-year off-take agreement with BP to secure the firm’s cash flow.

“It is an attractive investment,” the company leader said.

“The EU is a stable environment. Exploration in other areas including North Africa and Iraq is suffering because the politics are volatile and unpredictable.

“It’s very rare to find production in such shallow waters and in a place as nice as Greece.”

The company is now deploying a $225million investment plan in a bid to increase the Aegean Sea’s Prinos basin production to 10,000 barrels a day by the end of next year.

The plan includes 15 new wells, two additional unmanned platforms and extending the basin’s field life for an additional 15 years.

While the Prinos basin has been operating since the 1970s, Greece’s hydrocarbon potential traces back to 480 BC when ancient Greek historian Herodotus is credited with saying: “It is good to know that I personally have seen the tar they refer to on the lake and the waters of Zakynthos island.”

Energean is now exploring that same area the historian described.

Mathios added: “We are seeing the same oil seeds that Herodotus saw at the time.”

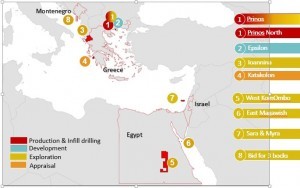

The Athens-based firm also has its sights set on exploration in Israel, Egypt and Croatia.

But for Mathios, it will always boil down to his home country.

It’s his hope that if Energean posts the kind of returns he thinks it’s capable of, it can play a pivotal role in writing the country’s financial wrongs.

He said: “In 15 years time I hope our children will be in a country that will suffer a lot less than we have in the past four years.

“My hope is that Energean will continue to develop and help Greece get out of its financial crisis.

“This industry could prove to be a very important revenue generator for the Greek people and there are very few industries that can play the same role in moving the government away from the challenges it faces.”

The industry leader knows his stacked game isn’t quite over – there’s still everything to play for.

“It’s extremely satisfying to see the company grow from what was practically nothing in 2007 to what it is today, but we still have to wait for the discovery that will put Greece on the map,” he said.

“For me words don’t mean anything until people invest their own money. We’ve invested more than $200million. Simply put, we believe in this and we’re putting our money behind it.”

He added: “Looking back it was a huge challenge. Now seven years later it’s been worth every moment and penny we’ve invested.”

Recommended for you