The City will focus on price reductions and cost-cutting programmes at British Gas owner Centrica, while supermarket Asda updates on its plans to bolster falling sales.

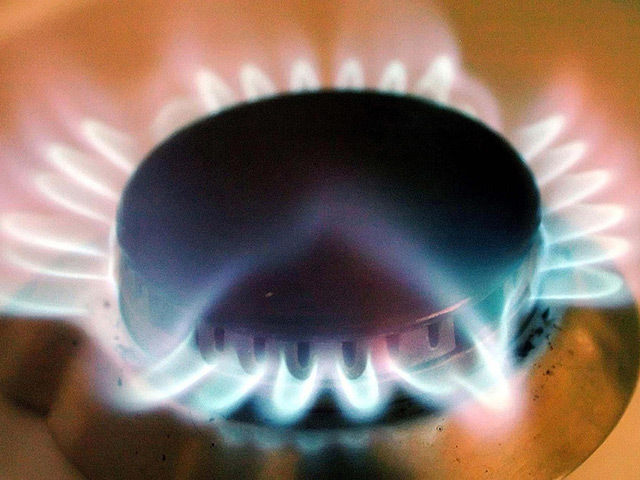

British Gas owner Centrica is expected to post a dip in annual profit on Thursday as the global fall in commodity prices takes its toll on the business.

The City expects it to report a 15% drop in adjusted operating profit to £1.4 billion, following wholesale gas prices falling by more than half over the last 12 months leading to lower profit

from its exploration and generating operations.

However, its profits from residential energy supply are also expected to jump 28% to £563 million, which will prompt anger from critics who complain steep falls in wholesale gas prices have not been passed on to customers.

British Gas and EDF Energy became the last of the Big Six providers to lower prices in recent days, announcing moves to cut gas bills next month.

British Gas said it will reduce gas prices by 5.1%, benefiting around 6.8 million customers, while rival EDF Energy is to bring down its standard gas tariff by 5%, making bills cheaper for around 900,000 customers.

The reductions follow announcements of cuts by rivals npower, SSE, E.ON and Scottish Power in recent weeks.

The British Gas cut will take effect on March 16, adding that customers will save on average £31 after the move.

It has already cut prices twice since the start of 2015 – in February and August – and said all three reductions together will bring average annual dual fuel energy bills down by £98.

British Gas holds around 40% of domestic gas accounts and 25% of electricity accounts. In total it holds 23.3 million business and customer accounts.

The moves come after Centrica completed a strategic review last July, under chief executive Iain Conn, which is aimed at delivering savings of £750 million over five years.

The firm said 6,000 posts would be cut across the group, around 10% of its workforce – although 2,000 new jobs will be created, so the net loss will be 4,000.

Centrica is also scaling back on its energy and production arm, cutting spending in this area by £1.5 billion over the next five years.

It will focus on the North Sea and east Irish Sea but is reviewing operations in Trinidad and Tobago and has decided that its Canadian business is now “non-core“’ and it will “seek ways to maximise value” from it.

Analysts at RBC Capital Markets welcomed these moves but added: “At the moment, these positives are being outweighed by earnings pressure from lower oil and gas prices.”

British Gas and the industry’s major players are also under regulatory pressure.

The Competition and Markets Authority (CMA) said in July British households were overpaying suppliers for their energy by around £1.2 billion a year and failing to switch to get the best deals.

The Competition and Markets Authority (CMA) has been carrying out a wide-ranging investigation into the energy market since last summer.

Supermarket chain Asda will reveal more details on its plans to stem falling sales when it announces full-year results on Thursday.

The chain, which is owned by US retail giant Walmart, is expected to put more flesh on the bones over its strategy to attract customers after revealing plans to invest £500 million into cutting prices last month.

It will also unveil how it faired over the crucial Christmas trading period, which saw better-than-expected performances from Sainsbury’s and Morrisons.

Asda abandoned discount day Black Friday during the key festive period, claiming its customers were tired of short-term discounting, in favour of lower regular pricing.

Analysts expect Asda to turn in quarterly like-for-like trading down by around 3.5%, compared with a year ago, while recent research by Kantar Worldpanel believes its market share has slipped

to 16.2% from 16.9%.

The Big Four supermarkets have come under increased pressure from German discounters Aldi and Lidl, which have carved out a slice of the UK grocery market and sparked a supermarket price war that has seen prices fall for more than a year.

Asda announced in January it would cut hundreds of jobs across the UK in its latest move to strengthen its competitive position.

The chain said it will make cuts in the “low hundreds” at its Leeds head office, which employs 3,000 people.

It comes after it announced a fresh 18-month overhaul in October which will see it slow store expansion in London, ease up on plans to build more stand-alone petrol stations across the UK and

scale back the rollout of its “click and collect” scheme as it seeks to cut costs.

Over Christmas Morrisons posted a 0.2% rise in same-stores sales for the nine weeks to January 3, while Tesco reported a 1.3% rise in like-for-like sales over the six weeks to January 9.

Sainsbury’s posted a 0.4 like-for-like sales fall in the 15 weeks to January 9, which was lower than expected.

Recommended for you