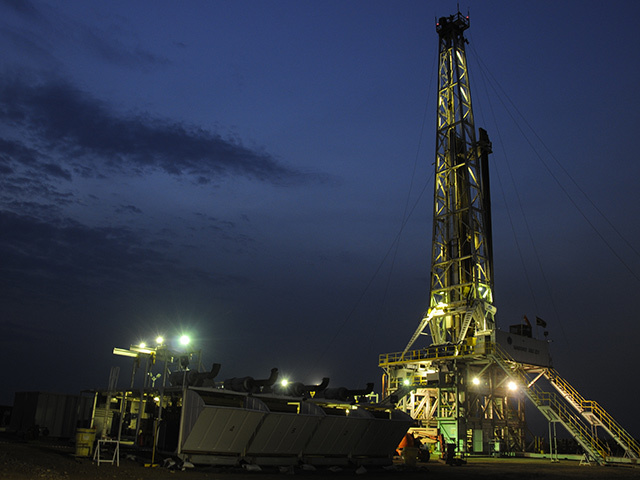

Tullow Oil said its TEN Project is on target for first oil in July and is now over 90% complete.

The company said its working interest production for the first quarter averaged 592,00 barrels of oil per day (boepd) and 6,500 for Europe which was marginally below expectations.

The lower than expected number was caused after damage to the Jubilee FPSO’s turret bearing.

Tullow and its lending banks have also completed a routine six-monthly Reserve Based Lending (RBL) redetermination process and agreed a 12 month extension to the maturity of its corporate facility.

The firm said the business remains well funded and at the end of April this year, the company will have $4.5billion and a utilised debt capacity and free cash of $1.3billion.

Chief executive Aidan Heavey said: “It has been a very busy start to the year for Tullow. In West Africa, we have made excellent progress with the TEN Project which remains on time and on

budget while a highly experienced project team are dealing with the turret issues on the Jubilee field FPSO.

“Following the decision of the Kenyan and Ugandan Presidents to develop standalone export pipelines, we now have much greater clarity and certainty around oil production in both countries.

“In Kenya, our appraisal campaign has also been very successful with ongoing assessment indicating increased resource estimates.

“Finally, I am very pleased to announce the completion of our RBL re-determination and the extension of our RCF.

“This demonstrates the continued strong support of our lending banks and is an important sign of confidence in Tullow’s excellent asset portfolio.”