IGas, one of the leading producers of hydrocarbons onshore in Britain, has revealed it is in talks with a number of potential investors.

The UK shale gas and conventional onshore operator said it continues to evaluate options for farm-outs and other asset portfolio management opportunities.

IGas is actively seeking to strengthen its balance sheet during the oil price slump and has been in discussions with its leading bondholders with a view to extending the maturity of the debt,

Opportunities include water injection, oil behind pipe, gas monetisation and infill drilling with the potential to increase production by around 700 boepd, net of decline, by January 2018.

IGas expects to produce between 2,500 and 2,700 boepd in 2016.

Oil prices have recovered to around $50 and it expects operating costs of around $30 per barrel for the year. The company had £23.6million of cash at the end of May.

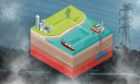

IGas operates one of the largest net shale acreage positions in the UK, with a significant total gross carried work programme of up to $255million.

The company said it is making good progress on its five year shale development plan, with two carried wells expected to spud in the first half of 2017, subject to planning and permitting.

Recommended for you