Shares in Plexus Holdings sank 5.68% to 60.25p yesterday after the Aberdeen oil engineer warned of a sluggish order book recovery.

Plexus said challenging trading conditions had persisted during the first half of 2017 as operators remain cautious on committing to new investment and projects.

The AIM-listed company said there would be a “material reduction” in its full-year 2017 revenues as a result.

Plexus chief executive Ben van Bilderbeek said he was “frustrated” it was taking longer than expected to win new contracts.

But Mr van Bilderbeek insisted Plexus, with its debt free balance sheet, was in a “strong position” to capitalise once activity in the sector resumes.

Plexus’s revenues dropped 44% to £3.7million in the six months to December 31, though pre-tax losses narrowed to £2.5million from £3.5million in the same period a year ago.

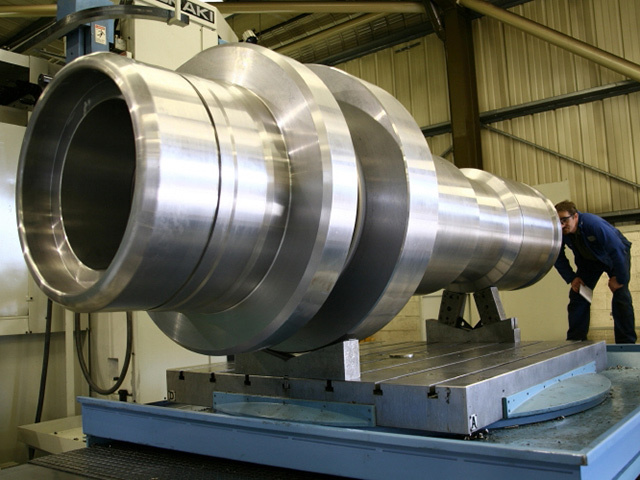

The firm’s Pos-Grip wellhead technology has been used on more than 400 wells worldwide.

Recommended for you