Oil’s 5 percent tumble Wednesday, the biggest slide since March, followed government data that showed U.S. crude and fuel stockpiles unexpectedly soaring at a time of year when they normally decline. Here are three charts showing what made oil bulls run scared.

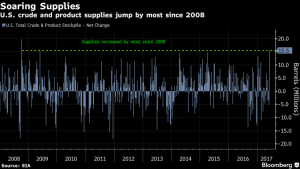

Stockpile Surge

Total U.S. inventories of crude oil and products such as gasoline and diesel fuel surged the most since 2008 last week, according to the Energy Information Administration. The 15.5 million-barrel jump took investors by surprise, sending the market off a cliff. What caused the increase? Higher imports of crude, as well as a sharp decline in exports. Add in a 505,000 barrel a day drop in gasoline demand and you end up with growing stockpiles.

“It’s about total stocks, crude and products, because that’s what the world wants to see, that’s what OPEC wants to see,” Michael Wittner, head of commodities research at Societe Generale SA in New York, said by telephone. “A week ago, you could say three of the past four weeks, it has come down, you are starting to see a trend develop. And then today, boom, the whole thing falls apart.”

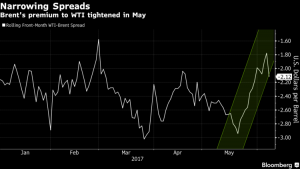

Dynamics Shift

What’s behind the import shift that helped cause the 3.3 million barrel build in nationwide crude supplies? The spread between the global crude benchmark Brent and its U.S. counterpart tightened during the second half of May, shrinking to a premium of $1.99 last week, the smallest since February. A narrower gap encourages imports and makes U.S. exports more expensive relative to oil from elsewhere. Imports rose by 356,000 barrels a day last week, while crude exports fell by 746,000 barrels a day, the biggest drop ever.

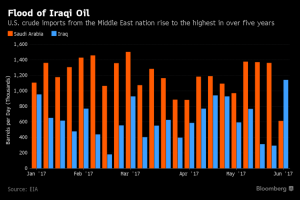

Iraqi Imports

Where did the flood of imports mostly come from? Imports from Iraq surged to 1.14 million barrels a day, the most since 2012, according to preliminary EIA data. That more than outweighed a drop in imports from Saudi Arabia, which sank 55 percent to the lowest level since January 2015.

“Today’s report was the straw that broke the camel’s back. We thought there would be no chance of a build in the oil market,” Phil Streible, senior market strategist at RJO Futures in Chicago, said by telephone. There’s a lot of chatter about oil heading back to the $20s again, he said.

Recommended for you