Oil headed for the first weekly gain since July as Gulf Coast refiners ramp up crude processing after disruptions from Hurricane Harvey.

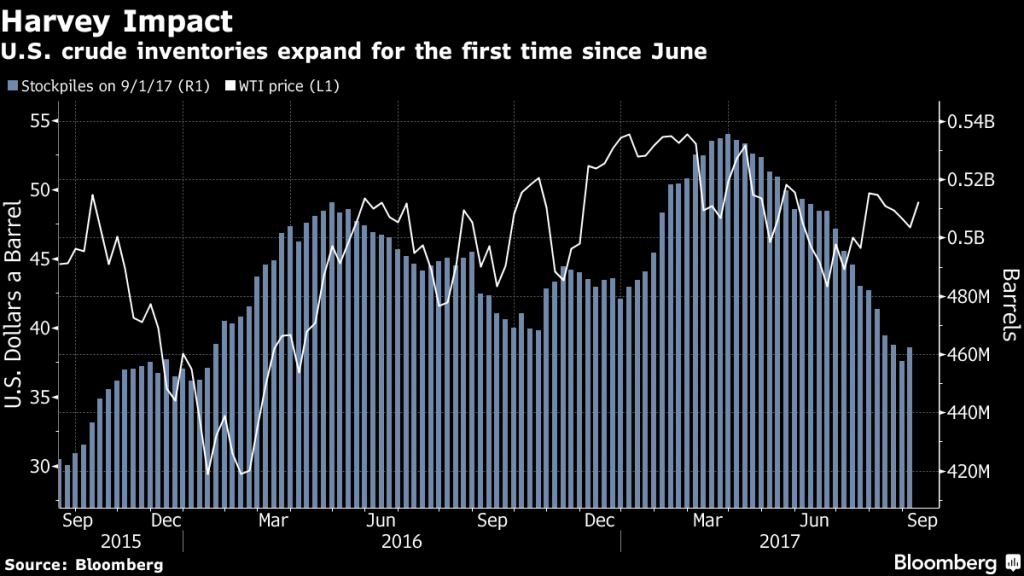

Futures were little changed in New York, up 3.4 percent for the week. About 8 percent of U.S. refining capacity remains shut after Harvey first made landfall two weeks ago, according to data compiled by Bloomberg. Almost a quarter of the nation’s capacity was halted following the storm. American crude stockpiles rose by 4.58 million barrels last week, the first gain since June.

While refineries, pipelines and offshore platforms resume operations after Harvey, another Atlantic hurricane, known as Irma, is approaching the U.S. coast and is set to hit Florida on Sunday. Imports into the Gulf Coast region last week fell to the lowest in records going back to 1990, and nationwide crude output fell below 9 million barrels a day for the first time since February.

“When refineries gave signals that damage was not too great and restarts were on the table, then crude rose back up and then continued higher,” said Bjarne Schieldrop, chief commodities analyst at SEB AB in Oslo.

West Texas Intermediate for October delivery was at $48.91 a barrel on the New York Mercantile Exchange, down 18 cents, at 10:36 a.m. in London. Total volume traded was about 4 percent below the 100-day average. Prices lost 7 cents to close at $49.09 on Thursday.

Brent for November settlement was up 19 cents at $54.68 a barrel on the London-based ICE Futures Europe exchange. Prices gained 29 cents, or 0.5 percent, to $54.49 on Thursday and are 3.6 percent higher this week. The global benchmark traded at a premium of $5.29 to November WTI.

Gulf Coast imports dropped by 41 percent last week to 1.48 million barrels a day, the lowest volume since at least January 1990, according to a report from the Energy Information Administration on Thursday. Nationwide crude output slid by 749,000 barrels a day to 8.78 million a day.

“While the fear last week was for reduced oil processing by refineries due to hurricane Harvey, the coin has now flipped,” said Schieldrop. “Now the concern is that this may be a heavy hurricane season with the risk of substantial disruptions to crude oil production in the Gulf of Mexico.”

Oil-market news:

Limetree Bay Terminals LLC’s St. Croix oil terminal in the U.S. Virgin Islands has been shut since Tuesday evening because of Hurricane Irma, according to a person familiar with the operations. Supply of Abu Dhabi’s Murban crude will be reduced to lifters in November and December due to planned maintenance, according to people with knowledge of matter.

Recommended for you