Statoil insisted it was on course to meet full-year targets despite seeing second quarter profits fall by almost 45% on last year.

The company posted a net operating income of 34.3billion krone (£3.8billion), compared to 62billion krone in the same period of 2012.

Net income was down to 4.3billion krone, compared to 26.6billion last year, while adjusted earnings after tax were down 0.2billion krone year on year to 11.3billion.

Unexpected outages, and the fall in oil and gas prices contributed to the drop in profits, which fell short of analyst predictions.

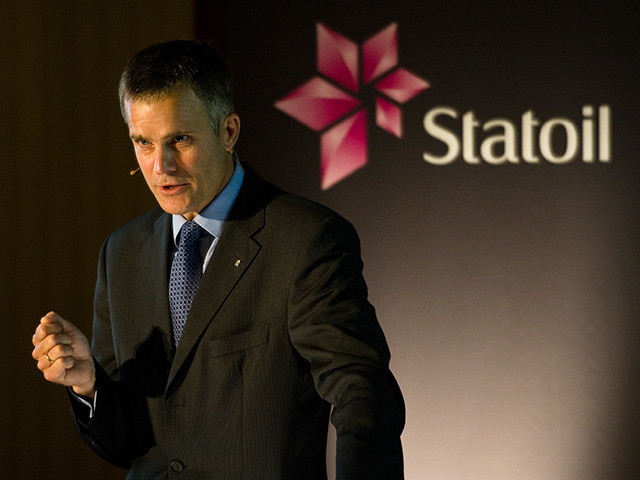

Statoil president Helge Lund insisted, however, the Norwegian giant would not scale back on operations for the rest of the year after record output on its fields outside Norway.

“Statoil delivered an operationally solid quarter,” he said.

“We produced as planned, delivering record production from our portfolio outside Norway. We are on track and maintain our guidance for 2013.

“Our financial results were impacted by lower prices for liquids and gas and weak trading results. However, we have maintained good cost control and delivered strong earnings, particularly from our international portfolio.

“The activity level on new field developments is high. We are executing our projects according to plan.”

The company, which announced earlier this year it was postponing work on the giant Johan Castberg project due to increasing costs and uncertainties over Norwegian taxes, said it was looking to complete 50 wells this year, with a spend of around £2.3billion over the course of 2013.

Statoil admitted it expected production to be down for the year overall compared to 2012, with maintenance in the forthcoming quarter expected to impact by 110mboe per day, mostly from the Norwegian Contintental Shelf.

Gas production in the USA is expected to be 25mboed lower than previous estimates, but the company insisted it was continuing to pursue its target increase production to more than 2.5 million boed by 2020.

Recommended for you