Tullow said talks to sell its North Sea and Dutch assets were continuing after seeing profits drop 45% to £313million for the first half of the year.

The company, which has been looking to sell off the Southern North Sea gas assets acquired from BP in 2000, said discussions over the assets were in progress and ‘good interest’ had been shown during data room visits.

Tullow said production from the North Sea averaged 10,000boepd for the first half of 2013, with system capacity and weather conditions around the CMS gas field having an impact on production – although the Ketch field was now delivering above expectations.

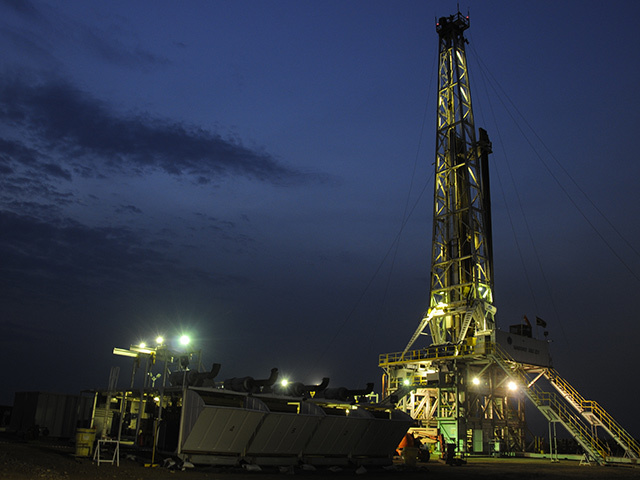

The sell-off comes after Tullow refocused on African operations, with the company confirming it was looking for partners to farm into its Tweneboa-Enyenra-Ntomme project off the coast of Ghana.

Talks over a farmdown of the TEN project are under way with the Ghanaian government, the company said, following a successful similar approach in Uganda.

Tullow is looking for a development carry from future partners following an increase in development costs to $4.9billion, excluding FPSO leasing.

“Our exploration-led growth strategy delivered major successes in Kenya and Ethiopia, further enhancing East Africa as a new oil region,” said chief executive Aidan Heavey.

“We have six exciting exploration campaigns under way in the second half in 10 countries with 20 wells targeting multiple basins. Tullow also has a considerable pipeline of development activity. This includes reviewing potential development options for the over 300 million barrels of oil discovered onshore Kenya, the farm down of our interest in the TEN project in Ghana and reaching the final stages of agreeing the key components of the Lake Albert Basin development in Uganda.”

Overall production rose in the first half of the year by 14%, to 88,600boepd.

Recommended for you