Norwegian oil giant Det Norske has agreed a $1billion revolving credit facility as it looks to fund its development of the giant Ivar Aasen and Johan Sverdrup fields.

The deal, struck with a group of international and Nordic banks, could be doubled to $2billion under the terms of the deal, which was finalised last night.

The five-year credit facility, which comes after Det Norske also raised more than 1billion Norwegian krone through equity deals.

“We are very pleased with the support Det norske has received from leading banks,” said chief financial officer Alexander Krane.

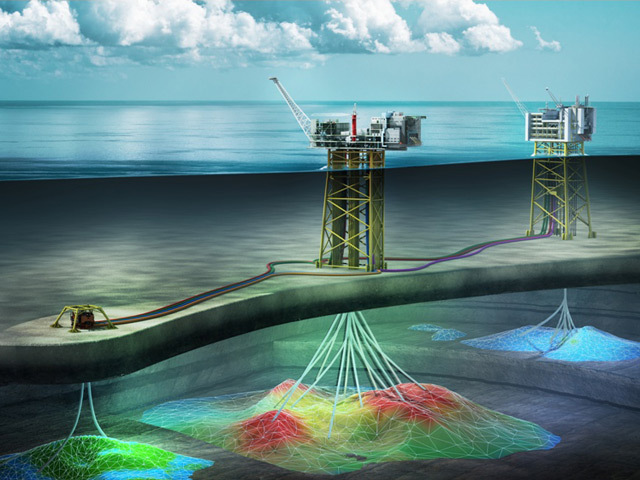

“This strengthens Det norske’s liquidity position, as we as operator have started the development of the Ivar Aasen field, and are to enter the development of the Johan Sverdrup field.

“The banks’ willingness to support the facility highlights the quality of our asset base.”

Det Norske has a 35% stake in the giant Ivar Aarsen field, which is thought to contain more than 150million barrels of oil, and a 20% stake in Johan Sverdrup.

However, it had previously been linked with a sale of some of its Ivar Aasen stake to fund further development of the 3.6billion barrel Sverdrup field.