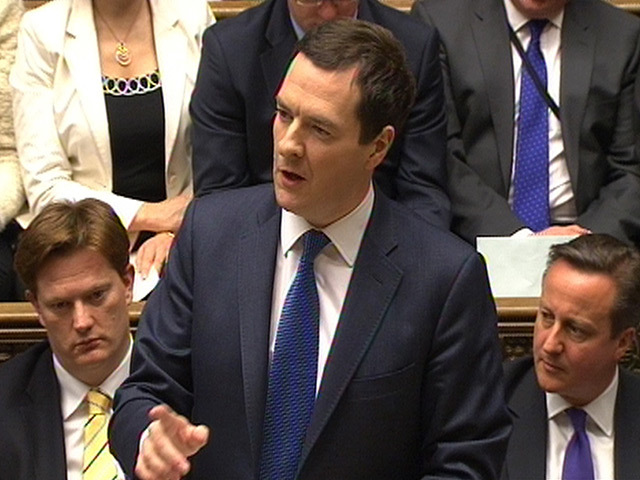

Chancellor George Osborne vowed to take forward all Sir Ian Wood’s recommendations from his review of North Sea oil – and offered new tax relief for the region’s more challenging fields.

But hopes that a dispute between the industry and the Treasury over the bareboat charter tax proposals would be resolved have failed.

The chancellor confirmed a new allowance would be introduced for High Pressure High Temperature fields as he delivered his budget speech for 2014.

But he warned that the amount of tax receipts predicted from the North Sea had been revised downwards by a further £3billion by the Office of Budget Responsibility.

Mr Osborne said they would take forward the findings of last month’s final Wood Review, which looked at ways to reinvigorate the UK continental shelf, as the government looked to ‘extract every drop of oil’ from the shelf.

As part of this, a new allowance would be made available to those developing HP/HT projects such as Total’s Elgin field.

One analyst said the proposed new tax allowance would go some way to encouraging field development in the North Sea.

BUDGET 2014 REACTION

Video: Oil and Gas UK ‘perplexed’ by bareboat tax push

Video: Experts warn of unhappiness over bareboat tax decision

Opinion: No surprises for energy sector

“The announcement of a new HP/HT allowance is the third attempt by industry and HM Treasury to introduce an incentive to support the development of large HP/HT fields,” said EY oil and gas head Derek Leith.

“The new allowance is different from its predecessors in that it is set as a percentage of capital spend including exploration and appraisal as well as development costs. As such, it is tailored more to the actual economics of the field.

“This is a significant development in the various fiscal incentives introduced to stimulate North Sea investment following increases in Supplementary Charge in 2006 and 2011. For the first time in an offshore context we have an allowance which is given directly in proportion to capital spend. This can be seen as the way forward for such allowances.

“It should enable the development of at least two large gas fields with related benefits to the supply chain and the UK economy as a whole.

But no change to plans to cap the amount deductible for leasing of large oil and gas offshore assets, despite lobbying from the industry, looks set to leave the industry with a sour taste.

Oil majors could face higher charges being passed on from leasing rigs on the UKCS, potentially costing the industry hundreds of millions of pounds.

“The confirmation that the Chancellor is to proceed with the legislation previously announced in the Autumn Statement to impose restriction on tax deductions for bareboat leasing costs is bad news for the UK oil & gas sector,” said EY tax partner Colin Pearson.

“With a tight rig market and cost pressures already acute, any additional costs will undoubtedly have an adverse impact on activity.

“The recent Oil & Gas UK Activity Survey highlighted the parlous state of exploration in the sector, a problem that is likely to be exacerbated by this change.”

In his speech, Mr Osborne highlighted North Sea oil and gas as a “key British export”.

As well as reviewing the tax regime, he said the UK Government would “introduce now a new allowance for ultra-high pressure, high temperature fields to support billions of pounds of investment, thousands of jobs and a significant proportion of our energy needs”.

The Chancellor went on: “Even with these measures, the North Sea is a mature basin – and the OBR have today revised down the forecast tax receipts by a further £3 billion over the period.

“The Scottish economy is doing well and jobs are being created. But this is a reminder of how precarious the budget of an independent Scotland would be. These further downgrades in the tax receipts would leave independent Scots with a shortfall of £1,000 per person.”

Scottish Tories said the drop in forecast oil receipts left a “black hole” of at least £4 billion in the Scottish Government’s figures for an independent Scotland.

But Mr Swinney said the pro-Union parties could not “simultaneously accept” a recent report projecting higher production from the North Sea and “at the same time cite the OBR forecasts of lower revenues from declining production”.

He added: “Increased investment in the North Sea will lead to increased production with a further 24 billion barrels of oil still to come from the North Sea.”

The Chancellor also announced a £7billion package aimed at cutting energy bills, which includes an £18 per ton cap on the carbon price support rate, from 2016 until the end of the decade.

The budget said there would be no change to the plans for new strike prices or renewable energy generation.

Don’t miss our eight page special on the Budget and its impact – only in tomorrow’s Press and Journal

Recommended for you