Jersey Oil and Gas (LON: JOG) boss Andrew Benitz said the first half of the year was marked by “highs and lows” as the success of its strategy in the North Sea’s Greater Buchan Area was tempered by UK Government plans to impose more windfall taxes and reduce investor incentives.

Jersey chief executive Andrew Benitz said the firm’s achievements have been marred by “fiscal and political turmoil” which has forced them to take measures including a 50% cut in staff and director salaries.

The project has the potential to create 1,000 jobs and attract £1billion of investment, he added.

In Jersey’s half year statement also added that while it would “continue to work tirelessly” to drive the Buchan development, it was now looking to invest in assets “through a wider lens than the historic focus on purely UK oil and gas”.

Buchan

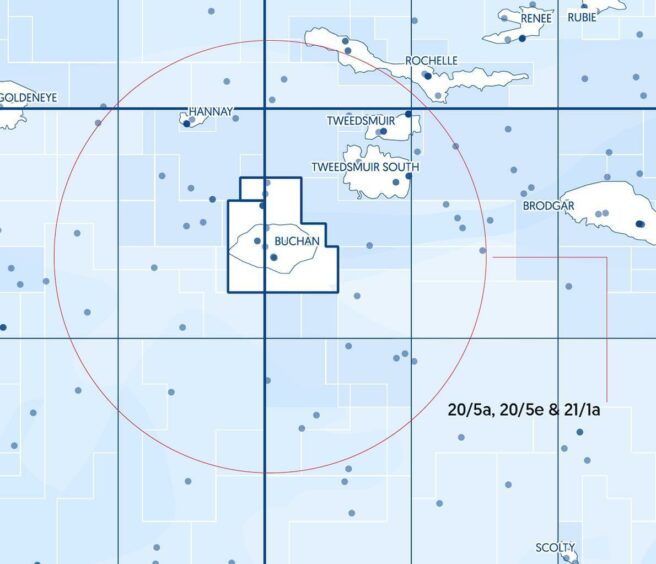

Jersey was awarded the North Sea Buchan licence in 2019. It brought on board partners Serica Energy (LON: SQZ) in February and NEO Energy which took over as as operator following a $170million transaction in 2023.

The Greater Buchan Area (GBA) covers several oil and gas accumulations around 93 miles (150km) north east of Aberdeen in the outer Moray Firth.

In his statement on the firm’s half year results, Benitz said: “The first half of the year has been marked by both highs and lows for the company.

“In February 2024, we celebrated completion of our second GBA farm-out transaction to Serica Energy.

“Critically, this enabled us to secure a fully funded 20% interest in the Buchan development project.

“This achievement was testament to the quality of the asset we have nurtured from inception and to the expertise and tenacity of the team.

“The high of this farm-out success has been tempered over the course of the year by the fiscal and political turmoil the UK oil and gas industry has faced.

“Whilst demand for hydrocarbons continues during the energy transition, developing homegrown energy provides the UK with a cleaner and more secure solution than relying on carbon intensive imported fuels.

“The Buchan project has the potential to create over 1,000 jobs across many parts of the UK supply chain and over 200 project related jobs, attract private investment of around £1 billion into the UK economy, generate hundreds of millions in UK tax revenues and deliver accelerated investment in new offshore renewable electricity generation.

“Against that backdrop, we hope that the Government will ensure that sense prevails and the right fiscal and regulatory environment is established to enable the UK’s oil and gas industry to continue being a highly valuable contributor to the economy for years to come, whilst we transition to a lower carbon economy.”

Earlier this month, private-equity backed NEO announced a “slow down” on part of the field, Buchan Horst, as it “awaits clarity regarding the UK regulatory and fiscal framework”.

JOG, which reported a loss £2.6million loss for the period, said the slow down would cut its annual cash spending on the project in half, from £3m to £1.5m.

This includes cutting staff and directors’ salaries 50%, the company said.

Finch Buchan delays

The firm said delays to the project meant the joint venture has requested a licence extension from the North Sea Transition Authority (NSTA) as it is now unlikely the field development plan will delivered ahead of Spring 2025.

The delay comes after the Supreme Court ruling on the Finch development, which set a legal precedent that requires regulators to consider the impact of burning oil and gas, called scope 3 emissions, in the environmental impact assessment (EIA) for new projects.

As a result of the ruling, the UK government launched a review on the impact on oil and gas developments which would report back in 2025.

Jersey said: “Completion of the pre-sanction project activities are being materially slowed down by Buchan’s operator [Neo], pending the outcome of both the forthcoming UK Government’s October Budget, particularly any potential additional changes to the Energy Profits Levy, and the environmental guidance consultation.”

Plea to government

Jersey said the Buchan project is “facilitating investment into cutting edge floating offshore wind”, which reflects key part of the industry’s pledge to decarbonise offshore facilities and invest in low carbon energy.

However it added “unwarranted fiscal raids” was having a disrpoportionate impact on independents like Jersey.

“Over recent years, the landscape in the UK North Sea has dramatically shifted away from “Big Oil” to smaller British independents like JOG, that are fully invested in UK waters.

“Successive unwarranted fiscal raids on our domestic energy industry is disproportionately damaging to these companies, which collectively account for the majority of current production in the region, as well as representing the primary source of future investment potential.

“With economic growth at the heart of the new UK Government’s agenda, it is hoped that the on-going fiscal and environmental reviews that the Government is consulting on will not lose sight of the essential importance of implementing measures that support investment, jobs and the acceleration of economic value creation for the UK economy.

“Along with our joint venture partners, over the last twelve months we have been actively engaging with the Government on the critical issues facing the industry and will continue to do so as the consultations progress.

© Supplied by Jersey Oil and Gas

© Supplied by Jersey Oil and Gas