© Supplied by EnergyPathways

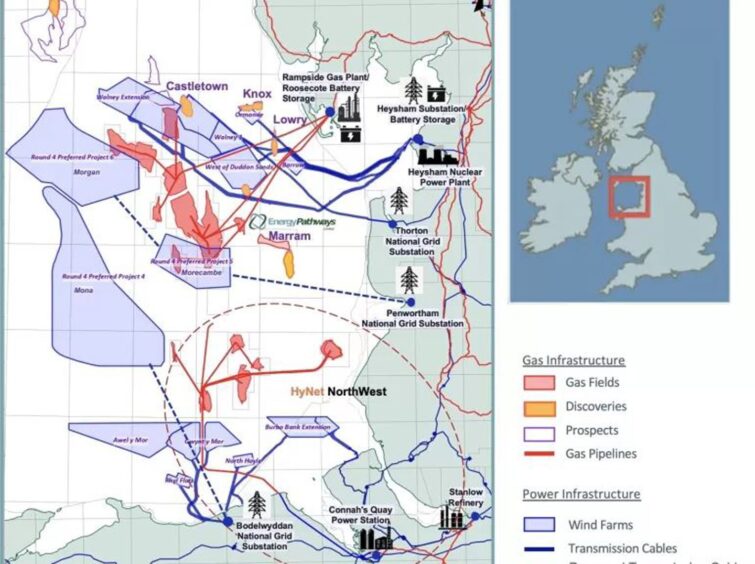

© Supplied by EnergyPathways EnergyPathways (AIM: EPP) has announced progress on its flagship gas production and storage scheme in the Irish Sea as it closes in on an investor to back the development.

The West Sussex-based energy company, which is primarily focused on developing the Marram offshore gas project, said it had struck a “non binding” agreement with a clean energy fund for a “cornerstone equity financing”.

Further, it said the agreement – a memorandum of understanding (MOU) – was “priced at multiples to current share price”, which would minimise shareholder dilution in the its proposed Marram gas field development and Marram Energy Storage Hub (MESH) project.

“This provides further demonstration to the government of MESH’s ability to attract private capital to the UK energy transition,” the firm added.

In an update which the firm said proves MESH is “positioned to accelerate the UK’s energy transition”, it added it has started “discussions” with an unnamed “tier 1 FTSE 100 company” which would use gas storage, buy gas in an off-take deal as well as provide debt finance.

It added it is awaiting a “critical” approval from the North Sea Transitional Authority (NSTA) on its gas storage licence application – which it said is “expected soon”.

Government targets ‘unsustainable’ without MESH

Ben Clube, CEO of EnergyPathways said: “EnergyPathways looks forward to advancing the MESH project with an award of the gas storage licence. MESH can make a major contribution to accelerating the UK energy transition and meeting the government’s 2030 clean energy targets.

“We are very pleased to have entered into a non-binding MOU for an equity placing to further demonstrate the company’s ability to attract private capital to the UK’s energy transition. In conjunction with the GGAF loan, it has increased the company’s financial flexibility and options and ability to create value for its shareholders.

“Our progress with a tier 1 FTSE 100 company on a long term gas storage capacity and gas offtake agreement along with project debt financing is very encouraging.

“With the UK government burdened by mountains of debt and limited scope to push up tax rates further, the UK’s heavy reliance on public financing to subsidise energy projects to meet its 2030 clean power target look unsustainable.

“The opportunities for private capital backed energy transition projects are increasing and it is clear the government is giving priority to projects that can accelerate the UK’s energy transition.

“The challenges of the UK energy transition are significant for all stakeholders involved. A very understandable challenge for UK regulators is the need to adapt regulations or their application to meet the government’s energy transition ambitions. Our experience has been that the UK regulators are effective operators in a moving landscape.

“Following consultation with the NSTA, EnergyPathways is very pleased to have the opportunity to restructure the petroleum licensing arrangements for its MESH project that complement the gas storage licence. The new petroleum licence puts the MESH project in a far firmer position. It enables EnergyPathways to develop MESH as an integrated energy system and better contribute to accelerating the UK’s energy transition.

“We look forward to working with the Government and regulators to help accelerate the UK’s energy transition.

More to follow.