Higher gas prices and dipping temperatures have seen Statiol’s profits climb.

Norway’s biggest energy company posted a 32% rise in profit for its first quarter take home figures.

Rising gas prices in the US compounded by unseasonably low temperatures in places like New York had a role to play in the spike.

Adjusted net income rose to 15.8billion kroner ($2.6 billion) from 12bn kroner a year earlier.

The firm is currently expanding its portfolio of oil international gas production to counter declining output from its North Sea deposits.

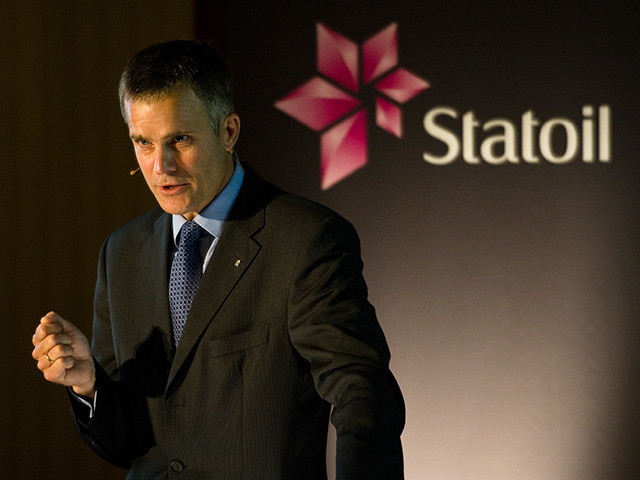

Chief executive Helge Lund said: “Higher prices and good results from our U.S. gas value chain contributed to a 9% increase in adjusted earnings.”

“Our operational performance is solid, providing the foundation for around 2% rebased organic production growth in 2014.”

The firm’s sales also rose by 6% to 169.9bn kroner. Net income rose to 23.6 billion kroner from 6.4 billion kroner a year ago. The company’s shares are at their highest level in almost six years. But this has been a year of cutting back for the Norwegian firm, which has slowed spending amid stagnant energy prices. Norwegian authorities warned the company and its counterparts of delaying productions in an effort to inflate returns.

The firm has since outlined healthy investment plans, totalling $20bn this year, of which £3.5bn will be spent on exploration.

Recommended for you