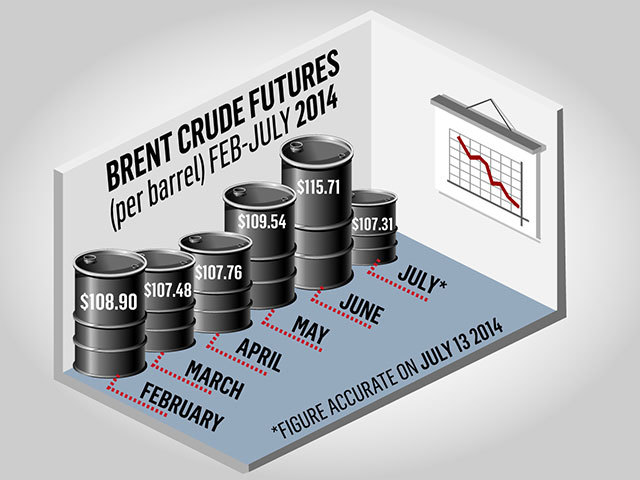

Brent crude continues to trade near a three month low.

Increased output from Libya has offset uncertainty over Middle East supplies.

Crude production in Iraq, for the moment, remains unaffected by an insurgency while Libya seeks to boost exports after two ports reopened. Both factors have contributed to the price dip.

Meanwhile, West Texas Intermediate (WTI) crude traded near its lowest price in two months.

A report from the Energy Information Administration due out tomorrow expects to show US gasoline stockpiles increased by approximately 900,000 barrels – its highest level since March.

“The key focus will be the EIA numbers,” David Lennox, a resource analyst at Fat Prophets in Sydney, said by phone today. “The US drive time looks solid but not as good as we were anticipating. The market has lost interest in the Middle East and that’s why we’ve seen a weakening in prices.”

WTI for August delivery was at $100.86 a barrel in electronic trading on the New York Mercantile Exchange, down 5 cents, at 11.16am Sydney time. The contract closed at $100.83 on July 11, the lowest since May 12. The volume of all futures traded was about 24% below the 100-day average. Prices have risen 2.5% this year.

Brent for August settlement, which expires tomorrow, was 18 cents lower at $106.80 a barrel on the London-based ICE Futures Europe exchange. The September contract was down 11 cents at $107.60. The European benchmark crude traded at a premium of $5.96 to WTI, compared with $6.07 yesterday.

Recommended for you