Statoil, Norway’s biggest energy company, said profit fell 12% in the second quarter as production declined because of maintenance work and asset sales.

Adjusted net income fell to $1.6billion from $1.8billion a year earlier, the Stavanger-based company said.

Net income rose to $1.9billion from $690million, while sales fell to $23billion kroner from $23.7billion kroner.

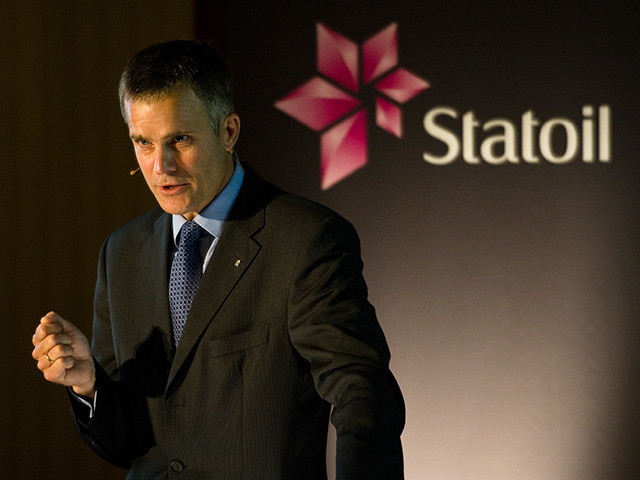

“Our quarterly earnings were impacted by divestments, seasonal effects and lower gas prices,” said Helge Lund, Statoil chief executive.

“We have deferred gas production to enhance value, but remain on track for delivering on our production guiding for 2014.”

State-controlled Statoil earlier this year joined other oil companies including Shell in cutting or slowing spending to counter rising costs and stagnant energy prices. Statoil said in February it would focus on improving shareholder returns at the expense of previous production-growth targets.

Output fell to 1.8million barrels of oil equivalent a day in the second quarter from 1.97million barrels a year earlier.

Statoil, which has sold more than $5.5billion of assets since October 2012, said in April that maintenance work would have a negative impact on production of about 110,000 barrels of oil equivalent a day in the quarter.

The 67% state-owned producer will pay a dividend of 1.8 krone ($0.29) a share for the second quarter.

Lund said in April the dividend for the second and third quarters would be at the same level as the 1.8 kroner payout for the first quarter.

Statoil got an average of $99.7 a barrel for oil in the second quarter, up from $93.9 a year earlier. Gas prices averaged $0.23 a cubic meter, down from $0.32 kroner a year earlier.

Recommended for you