Royal Dutch Shell Plc’s acquisition of BG Group Plc not only increases access to deep-water fields in Brazil, but provides greater heft in dealings with Petroleo Brasileiro SA, the local partner mired in a graft probe.

With Petrobras engulfed in Brazil’s largest ever corruption scandal, BG and other partners are struggling to communicate with the state-controlled producer’s management to address delays to development plans.

For BG and Galp Energia SGPS SA, which are relying on future Brazilian output to bolster cash flow, this uncertainty is a bigger problem than for Shell, which has a larger and more diversified portfolio.

“Shell has more patience and financial strength,” Juan Ramon Fernandez Arribas, an independent analyst based in Madrid, said in an e-mail. “It can wait more to develop its projects and is a more solid operator than BG. That’s a big advantage in the discussions with Petrobras.”

Shell today agreed to buy BG for about 47 billion pounds ($70 billion) in cash and shares, the oil and gas industry’s biggest deal in at least a decade.

The acquisition will “provide Shell with enhanced positions in competitive new oil and gas projects, particularly in Australia LNG and Brazil deep water,” The Hague-based company said in a statement on Wednesday announcing its takeover offer.

BG’s Brazilian portfolio will become a key growth driver for Shell, with production set to increase to 557,000 barrels a day by 2020 from 144,000 in 2015, Jefferies analysts lead by Jason Gammel wrote in a note to clients on Wednesday.

“Brazil is the key strategic driver,” the Jefferies analysts said. “The transaction makes Shell the leading foreign oil company in Brazil.”

Shell also has operations in Brazil and partnerships with Petrobras, including the giant offshore Libra project. The difference is that for BG, Brazil is projected to account for a third of its production by 2020, while for Shell its not even 10 percent of its operations.

BG has non-operating stakes in five blocks in the pre-salt area, an offshore region where Petrobras made the world’s largest discovery in at least three decades between 2006 and 2007. The blocks already account for about a sixth of BG’s output.

The largest field there is Lula, a partnership between Galp and operator Petrobras, with recoverable reserves estimated at 9 billion to 11 billion barrels. Last month, Galp’s Chief Executive Officer Manuel Ferreira de Oliveira said the company hasn’t been able to receive confirmation from Petrobras on delays to platforms for Lula. Galp said the delay could be as much as a year.

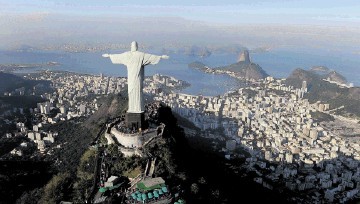

BG, whose Brazilian offices are located across the street from Petrobras’s offices in Rio de Janeiro, in 2013 announced that it would build its global technology center in the Brazilian city as a sign of the importance of their local operations.

Recommended for you