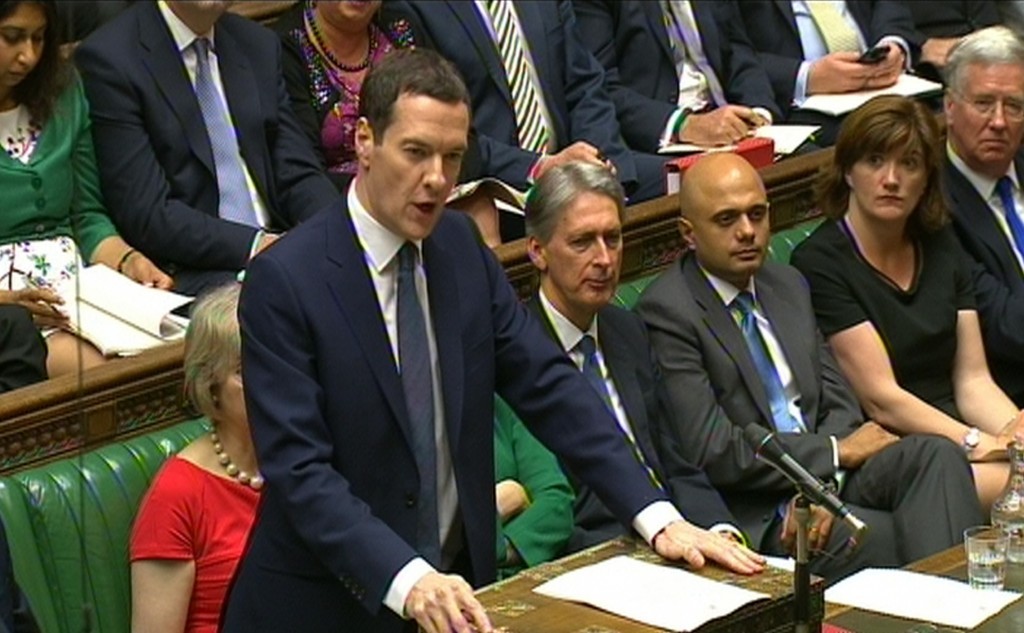

Chancellor George Osborne insisted the government would deliver on its promise to reduce the North Sea’s supplementary tax charge from 30% to 20%. He also announced a move to open up the remit for industry investments to qualify for allowances – a move aimed a fueling production.

He said: “The large reductions in tax on North Sea oil and gas I announced in March are going ahead, and today we broaden the types of investment that qualify for allowances.”

A spokeswoman said the broadening would now include spend on investment designed to increase production – the leasing of production vessels and facility renewal spend, including the replacement of life expired valves pumps all qualify.

Spend to improve production efficiency including treatments to remove build ups of deposits in wellbores and pipelines will also qualify.

A total of 125 firms are set to benefit from the expansion when it comes into effect this Autumn. The plans will cost the government £5millon a year.

The budget document gave more detail on plans to leverage the North Sea’s potential.

It read: “The government believes in making the most of the UK’s oil and gas resources, including the safe extraction of shale gas. Building on action set out in the March Budget 2015, the government will expand the North Sea investment and cluster area allowances to include additional activities which will maximise economic recovery.”

However, Dr Alex Russell, Professor of Petroleum Accounting at Robert Gordon University, insisted the Chancellor fell short in the industry’s hour of need.

“Mr Osborne really should have done more,” he said

“The oil industry is teetering on the brink. If it declines the knock on effect for Aberdeen and Scotland is going to be catastrophic. It is imperative the UK Government takes action to keep the economy going.

“With respect to Scotland in general and Aberdeen in particular there should have been recognition of the economic impact that the declining revenues from North Sea oil will have on the economy of the country. The Chancellor could have acted to relieve the industry completely on an interim basis from its punitive tax regime. One solution would have been to treat the oil industry like every other UK industry and have it pay corporation tax at 20%.”

He added: “The alternative for the industry is to start a potentially catastrophic decommissioning phase with huge job losses across the UK. Other economic activity in Scotland would be adversely affected by the demise of the oil industry. Given the Smith Commission’s devolution of some tax and welfare powers to Scotland with a consequent reduction in the Barnet formula funding to Scotland the loss of a significant part of its economic base is of real concern to Holyrood.”

Graeme Lewis, group commercial director at Air Energi echoed Russell’s call for more.

He said:“It’s disappointing to see that there have been no further oil and gas tax breaks announced in the latest Budget. Considering the challenges being faced by the industry in the North Sea, there is a real chance that this approach will risk more jobs in the sector.

“The Government could, and should, have done more to support the industry at this difficult time.”

Alex Kemp, Professor of Petroleum Economics and Director of Aberdeen Centre for Research in Energy Economics and Finance, said the lack of detail leaves both future Budgets and the industry’s options wide open.

He said: “The statement doesn’t elaborate on what the Government means in terms of North Sea investment and additional activities.

“Ideally, more measures might have been expected but those who were close to the process of decision making would know there was not much time available for specialists in the Treasury to come with other schemes.

“I think there is room for some optimism looking towards the Autumn statement.”

“Before the March Budget there was discussion on whether the investment allowance should apply to infrastructure in the North Sea and to materials such as polymers, which could be applied Enhanced Oil Recovery. This appears to remain an option.”

The Budget will trigger sector-wide discussion in regards to the North Sea future, according to Professor Paul de Leeuw, director of Robert Gordon University’s Oil and Gas Institute.

He pointed towards the Autumn statement as a marker for more answers.

He said: “Huge steps forward were taken in March this year with the introduction of the Investment Allowance and there is a far better conversation taking place between government and industry via bodies such as PILOT and the Fiscal Forum. Infrastructure needs to be maintained as long as possible.

“We need to get exploration right and the situation is well recognised by all parties. Everyone appreciates the seriousness of the situation. The new regulator. the Oil and Gas Authority, absolutely gets it that we need to have the right fiscal stimulus for investment in exploration.

“There will be some quite in-depth conversations between government and industry taking place between now and the Autumn budget.”

Elsewhere, the Industry body Oil and Gas UK welcomed the Government’s confirmation it would be broadening the types of investment qualifying for an allowance, as well as the phased 2% cut in corporation tax for non-ring fenced trade.

Chief executive Deirdre Michie said: “With continued signs that investment in the UKCS is falling rapidly, it is vital the scope of the Investment Allowance, announced in the March Budget, encourages all forms of productive investment if it is to provide the strongest engine for growth. We are pleased to note the Government has taken steps to extend this allowance as they previously proposed and eagerly anticipate the required legislation by the end of the summer.

“There is increasing evidence big strides are being made to improve the efficiency and reduce the cost of operations. Lifting costs are anticipated to fall as a result over the next 12 months. The pace of work behind the scenes must now be stepped up to continue the implementation of fiscal reform the industry urgently needs to support its own activities to improve efficiency.”

“We would like to acknowledge the continued commitment of the UK Government to provide a competitive tax regime as part of the shared objective to maximise economic recovery from the UK Continental Shelf (UKCS).

“Whilst previous fiscal measures including the introduction of the Investment Allowance and reductions in the headline tax rates have been helpful, the agreed programme of fiscal reform must also continue to respond to the prevailing business environment.”

Energy and tax partner Tom Cartwright at Pinsent Masons, Tom Cartwright, insisted the expansion of the investment allowance will help the industry adapt to a “new normal”.

“Any expansion of the investment allowance will be welcome as North Sea developers adapt to a new normal,” he said.

“The move sends a helpful signal to operators that government remains committed to UK hydrocarbons. Whether they see this action as enough when many fields require significant investment is another issue.

“With the launch of the OGA and the Wood Review implementation gathering pace, a new era for North Sea oil and gas is emerging. Fiscal support and stability of energy policy is central to that as many players have grappled with incoherent messages and an ad-hoc system of taxation for some time. Attracting investors into a mature basin is not without challenge but remains important from a fiscal perspective.”

However, the Chancellor was challenged on his ‘lack’ of attention to energy efficiency.

John Alker, director of policy and communications at the UK Green Building Council, said Osborne failed to be ‘bold’.

He added: “George Osborne promised a Budget that would be bold in delivering infrastructure. Yet energy efficiency, which should be seen as one of the UK’s biggest infrastructure priorities, failed to even get a look in.

“Energy efficiency is an economic no brainer – cutting bills for households, creating jobs and growth, and improving our energy security. Government’s failure to support this industry at a time when uncertainty about the future of ECO and Green Deal is rife, represents a major missed opportunity for the economy.

“We welcome the review of the landscape for business energy efficiency – however, this must be about smarter regulation, rather than an ideological slashing of perceived red tape.”

The chief executive of Love Energy Savings backed the call for greater detail to energy efficiency.

Phil Foster said: “The lack of energy-specific announcements made by George Osborne in his Summer Budget address was disappointing. While it’s encouraging to hear the government is committed to introducing 24-hour energy tariff switching by the end of 2018, the fact remains that more needs to be done to slash gas and electricity prices across the board.

“From an energy generation standpoint, the Chancellor mentioned North Sea oil and gas developments in his speech, but there was precious little said about renewables. On the back of last month’s bombshell that onshore wind farm subsidies will be removed a year earlier than initially planned, I was hoping that Mr Osbourne would use his Emergency Budget announcement to allay fears about the UK’s commitment to investing in sustainable energy sources, but this didn’t happen.”

Did the Chancellor do enough? Have your vote here.

Recommended for you