Lundin Petroleum inked a fourth quarter loss of $494million after being hit with impairments.

The final quarter turnover was $136million, which includes a net foreign exchange loss of $129.2million and an after tax impairment charge of $296.3million.

President Alex Schneiter said: “We continue to witness extreme volatility in oil prices with falls to levels not seen in over a decade and it is clear to me that the battle for market share is approaching its final conclusion.

“At current price levels I believe a rebalancing of supply and demand is inevitable and likely to take place during the second half of 2016 as higher cost producers are forced to curtail production levels.

“We know from our own experience that unique and highly prized assets such as Johan Sverdrup are not discovered every day and it is only fields with these characteristics that can be developed at current price levels. All fields face natural decline and therefore the significant investment cuts and project deferrals that we have seen will ultimately lead to a recovery in oil prices.

“That being said we must face the realities of low oil prices and the best strategy in such market conditions is to execute on and deliver a low cost asset base.”

The firm said despite the loss it had healthy reserves of close to 700 MMboe and it expects its operating costs to below $10 per barrel.

Schneiter added: “In 2016 our strategy remains unchanged and our main focus will be the southern Barents Sea where we will be active on both fronts; exploration and appraisal with a particular focus on the existing Alta discovery area. I firmly believe that the southern Barents Sea potential is significant and this is a region where the Company will dedicate significant resources for the years to come. Further exploration drilling will also be taking place on the Utsira High and in the Sabah area in Malaysia.”

However, the company leader said despite the turnover disappointment there was a clear winner in a low oil price environment – the Johan Sverdrup project.

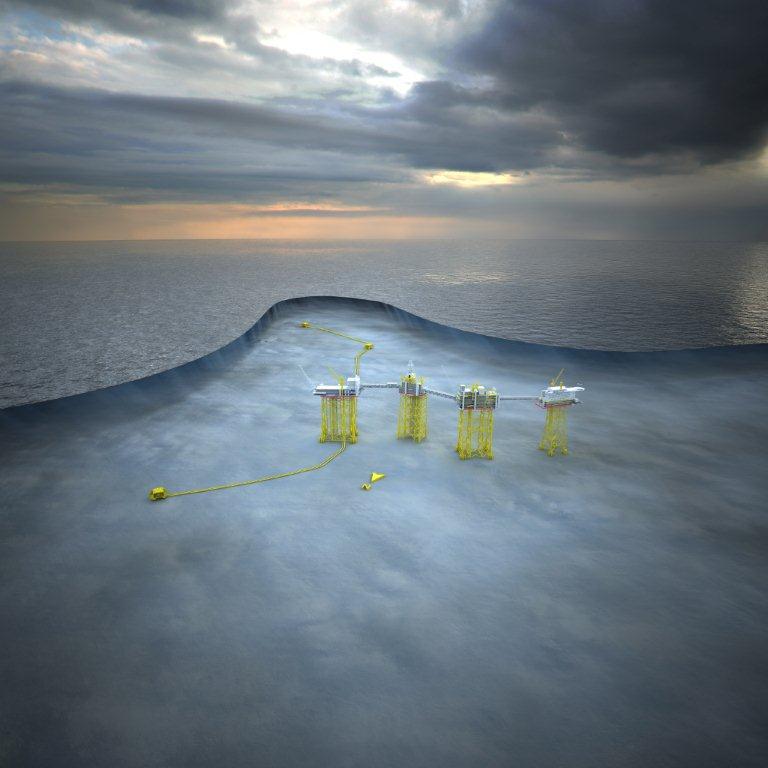

Lundin is stakeholder the in the flagship development alongside operator Statoil. The project’s phase one development costs have been reduced from NOK123billion to 108billion.

Schneiter said: “Johan Sverdrup is ideally positioned to take the full benefit of this challenging environment and corresponding low oil price. There is no better time to go in the market and award contracts. I anticipate we will see further cost savings in Johan Sverdrup, which will further improve the economics of this world class project.”

More to follow.

Recommended for you