Exxon Mobil, the world’s largest publicly traded oil company, has revealed its output would rise slowly in 2017 as it continues cutting costs.

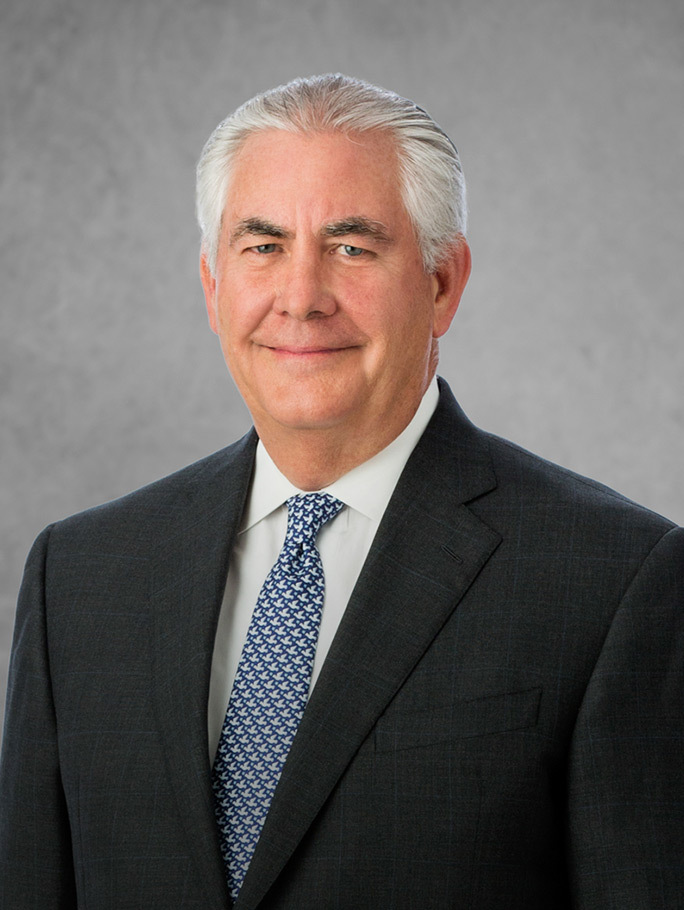

But chief executive Rex Tillerson said the company, which raised $12 billion in the debt market earlier this week, could increase its spending if the right opportunities arose.

“We have the financial flexibility to pursue attractive opportunities and can adjust our investment program based on market demand fundamentals,” Tillerson said.

The company anticipates capital spending of $23 billion in 2016, down 25% from 2015.

The company, which met with analysts in New York, said it expects its 2017 capital spending to be lower.

Exxon said it would continue to selectively advance its investment portfolio, building upon attractive longer-term opportunities.

It also said it is on track to start up 10 new oil and gas projects through the end of next year, adding 450,000 barrels of oil equivalent per day to its production capacity.

Exxon’s oil and gas production rose 3.2% in 2015, as the company’s downstream refining unit provided some insulation against falling oil prices that have hit its upstream exploration and production unit.

The company’s spending peaked at $42.5 billion in 2013 and has been falling since then. In early 2015, it said its average annual spending would be around $34 billion over the next several years.

Exxon Mobil has increased its dividend for 33-consecutive years through 2015, with an annual increase of 10% per year over the past 10 years. On average, 48 cents of every dollar generated by the business during the last five years has been distributed to shareholders.

Recommended for you