Hedge funds really wanted the Doha oil summit to work.

Money managers kept wagers on rising prices near a nine-month high in the days leading up to Sunday’s meeting of oil producers.

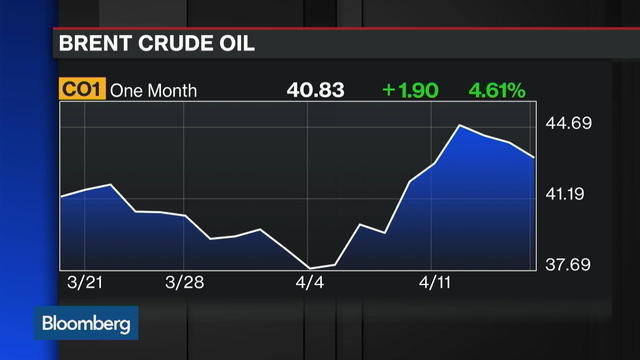

Then the negotiations between OPEC members and other producers ended without a deal to limit output after Saudi Arabia and other Gulf nations wouldn’t agree to any accord unless all OPEC members joined, including Iran. U.S. crude futures in New York tumbled as much as 6.8 percent to $37.61 a barrel on Monday.

The failure of the first significant attempt at coordinating oil supply between the Organization of Petroleum Exporting Countries and nations outside the group in 15 years threatens to undo a more-than 30 percent gain in U.S. prices since the Saudis and Russia announced a preliminary plan in mid-February.

“Speculators came in on expectations that an agreement would be all but signed by Thursday and Friday,” said Bob Yawger, director of the futures division at Mizuho Securities USA in New York. “You started seeing them exit as the chatter died down.”

After rising to $42.17 a barrel April 12 on the New York Mercantile Exchange, West Texas Intermediate crude prices slid for three days through Friday amid doubts that a decision could be reached while Iran, which is boosting oil exports after years of sanctions were lifted in January, has ruled out limiting output.

The prospect that producers might cap supply buoyed optimism that prices had reached a bottom. Hedge funds’ net-long position in WTI futures and options is more than twice as large as two months ago, after increasing by 11 percent in the week ended April 12, U.S. Commodity Futures Trading Commission data show.

A drop in prices after the failure to reach a deal may be tempered as oil production in Kuwait fell by 60 percent after oil workers went on strike Sunday. Output dropped to 1.1 million barrels a day according to Saad Al-Azmi, a spokesman for Kuwait Oil Co. That’s down from 2.81 million last month.

Data Snapshot

Global oil markets will “ move close to balance” in the second half of the year as lower prices take their toll on output outside OPEC, the International Energy Administration said in a report on April 14. The world glut will ease to 200,000 barrels a day in the last six months of the year from 1.5 million in the first half, the IEA said. U.S. shale production may sink next month to the lowest level in almost two years, the Energy Information Administration estimated April 11.

“We’ve seen sentiment shift,” said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. “There’s optimism about the market tightening and a feeling it will be sooner rather than later.”

In other markets, net bearish wagers on U.S. ultra low sulfur diesel decreased 59 percent to 8,778 contracts, the least since June. Diesel futures surged 19 percent in the period. Net bullish bets on Nymex gasoline dropped 6 percent to 20,356 contracts as futures advanced 11 percent.

Speculators’ net-long positions in WTI gained by 20,857 contracts of futures and options combined to 215,630, CFTC data show. Short positions, or bets that prices will decline, fell 18 percent, while longs climbed 0.8 percent.

“We’re not seeing a dramatic increase in those who think the market is going a lot higher,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York. “These were investors covering their vulnerability” to a rally, he said.

Recommended for you