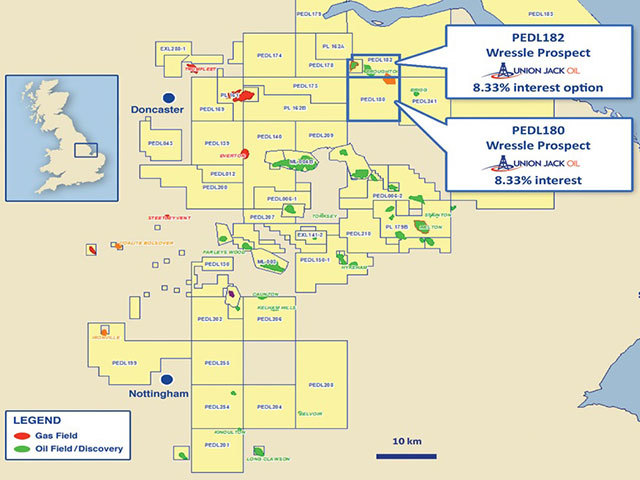

Union Jack Oil said it has acquired a further 8.33% economic interest in an onshore asset in Lincolnshire.

The company has reached an agreement with Egdon Resources which will see it gain the stake in PEDL182 on the western margin of the Humber basin containing the Broughton North Prospect.

Under the terms of the agreement, Union Jack will pay Egdon 12.49% of the cost of any planned Broughton North Well and associated agreed back costs of $64,000.

Union Jack said the costs relate primarily to the acquisition of high quality 3D seismic acquired during 2012 over the Broughton North Prospect and other areas within PEDL182.

This exercise has provided detailed structural data and enabled a bottom-hole target location in respect of the Broughton North Prospect.

Union Jack`s share of funding of the Broughton North well will be paid for by hydrocarbon sales from the Wressle-1 commercial production, which is expected to commence during the fourth quarter of this year.

David Bramhill, executive chairman of Union Jack, said: “This acquisition affiliates two prospective licence areas, already demonstrated by the Wressle-1 oil and gas discovery.

“In addition to Wressle, which is anticipated to produce first oil during Q4 2016, Union Jack has also acquired a portfolio of high calibre licence interests containing several drill-ready prospects including Biscathorpe, North Kelsey, Keddington, Holmwood, Louth, North Somercotes and Broughton North.”

Recommended for you