US energy giant ExxonMobil today revealed a 59% drop in second quarter earnings, blaming low crude prices and weak returns from refining.

ExxonMobil said its global upstream earnings slumped 82% year-on-year to $294million (£223million) during the three months.

Downstream earnings came to £625million, down £516million from the second quarter of 2015.

But ExxonMobil, which has an interest in about 40 producing North Sea oil and gas fields, said it posted slight increases in oil production and sales in Europe.

Global production volumes held firm at 4 million barrels of oil equivalent (boe) per day and income from chemical remained strong at £910million.

The company also managed to cut its spending by 38% to £3.9billion during the period.

It ended the quarter with net earnings of £1.29billion compared to £3.18billion a year ago.

And ExxonMobil booked pre-tax profits of £1.8billion, down 65% year-on-year, on revenues of £44billion.

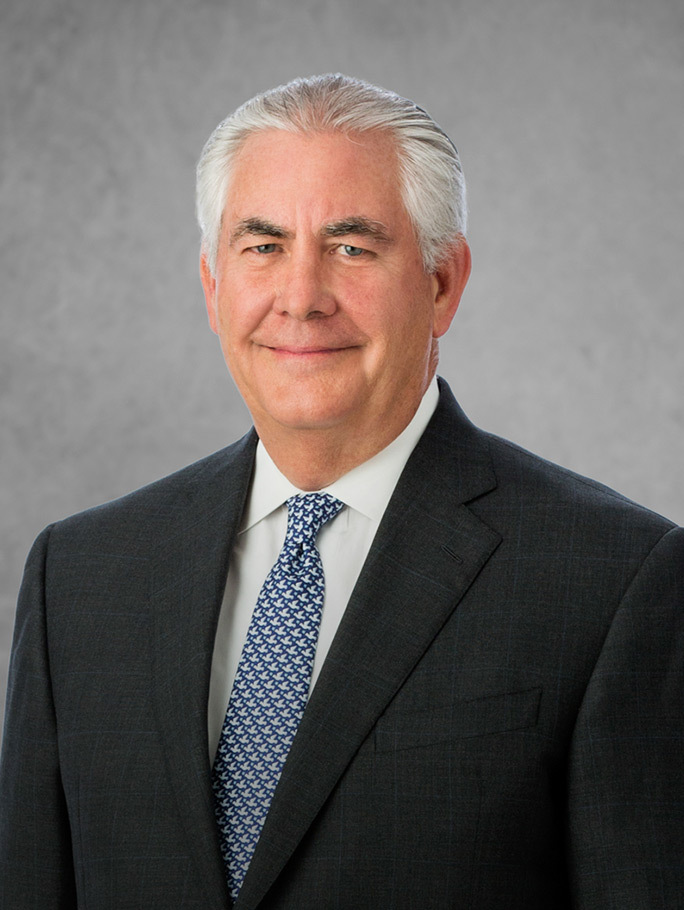

Rex Tillerson, chairman and chief executive officer, said: “While our financial results reflect a volatile industry environment, we remains focused on business fundamentals, cost discipline and advancing selective new investments across the value chain to extend our competitive advantage.

“The corporation benefits from scale and integration, which provide the financial flexibility to invest in attractive opportunities and grow long-term shareholder value.”

ExxonMobil paid out £2.3billion in dividends to shareholders.

The company employs more than 6,500 employees and 1,500 contractors in the UK and has a base in Aberdeen.

Recommended for you