U.S. shale is getting in the way of a New Year’s resolution by OPEC to cut production and boost the market.

Producers and merchants increased their bets on lower West Texas Intermediate crude prices to the highest level since 2007 as futures held above $50 a barrel. The increase in hedging against a price drop signals a comeback in U.S. shale output, just as OPEC members and other producers seek to reduce supply.

The Organization of Petroleum Exporting Countries reached an agreement in November to cut production by 1.2 million barrels a day for six months starting in January, and were joined by 11 non-OPEC nations in an effort to reduce a global glut. The Energy Information Administration last week raised its forecast for 2017 U.S. crude production. A Barclays Plc survey showed North American oil and gas explorers will spend 27 percent more this year.

“It may not all be physical above-the-ground inventory that is being hedged, but it may be a portion of 2017 and 2018 planned production,” Tim Evans, an energy analyst at Citi Futures Perspective in New York, said Friday. “Certainly, if there was strong conviction that oil prices are heading for $70, then producers would be less inclined to sell at current levels.”

Producers and merchants increased their short positions, or bets on lower prices, to 675,968 futures and options in the week ended Jan. 10, U.S. Commodity Futures Trading Commission data show. WTI fell 2.9 percent to $50.82 a barrel during the report week, and added 0.4 percent to $52.56 at 12:29 p.m. Singapore time on Monday.

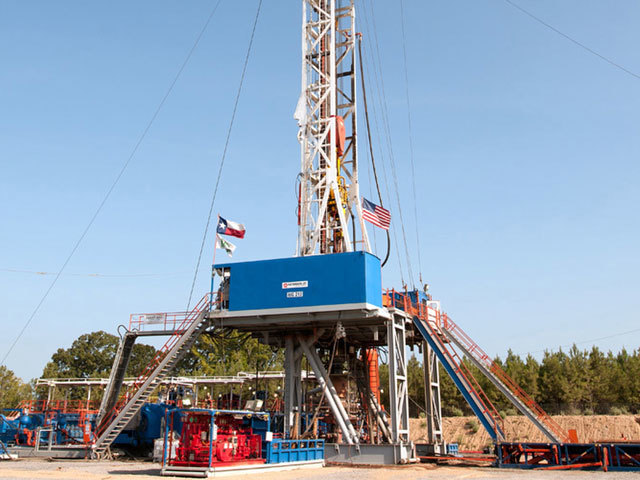

Making a Comeback

The U.S. oil rig count increased 10 out of the past 11 weeks, according to Baker Hughes Inc. data. The EIA also reported that U.S. crude output rose to the highest level since April in the week ended January 6, while crude stockpiles surged by the most since November.

Saudi Arabia, the world’s biggest oil exporter, cut output to less than 10 million barrels a day, below its targeted level, Energy Minister Khalid al-Falih, said Thursday. Algeria will cut its oil output by more than it agreed, while Iraq hopes to meet its full cut by the end of the month.

Hedge funds held mostly steady during the period, CFTC data show. Money managers’ net-long position rose 0.5 percent to 305,909 while long and short positions both fell.

In fuel markets, net-bullish bets on gasoline rose 3.3 percent to 63,443 contracts, the highest since July 2014, as futures fell 4.6 percent. Money managers cut net-bullish wagers on ultra low sulfur diesel by 17 percent to 32,481 contracts, as futures slipped 3.9 percent.

Deal Compliance

The group will adopt compliance mechanisms at a meeting in Vienna on Jan. 22, OPEC Secretary-General Mohammad Barkindo said in a Bloomberg Television interview Friday. Members of OPEC will meet in May in Vienna to assess the market and decide whether the group, as well as non-OPEC producers, need to extend the agreement to curb production, Barkindo said.

Investors are looking at “compliance and the response of what shale is going to be,” Michael D. Cohen, the head of energy commodities research at Barclays Capital in New York, said Friday.

Higher production elsewhere will complicate OPEC’s task. U.S. oil output will grow by 110,000 barrels a day this year and will be higher on an annual basis by April, the EIA said in its Short-Term Energy Outlook Jan. 10. One producer exempt from the deal, Libya, increased output to 700,000 barrels a day, a National Oil Corp. official said earlier this month.

Producers are “protecting themselves,” Tariq Zahir, a New York-based commodity fund manager at Tyche Capital Advisors LLC, said Friday. “The production increase from the U.S. coupled with Libya’s increases are really going to hit the market going forward.”

Recommended for you