The North Sea reshuffle of early 2017 shows the stalled oil and gas industry is back on the move “with a real positive momentum”, according to one expert.

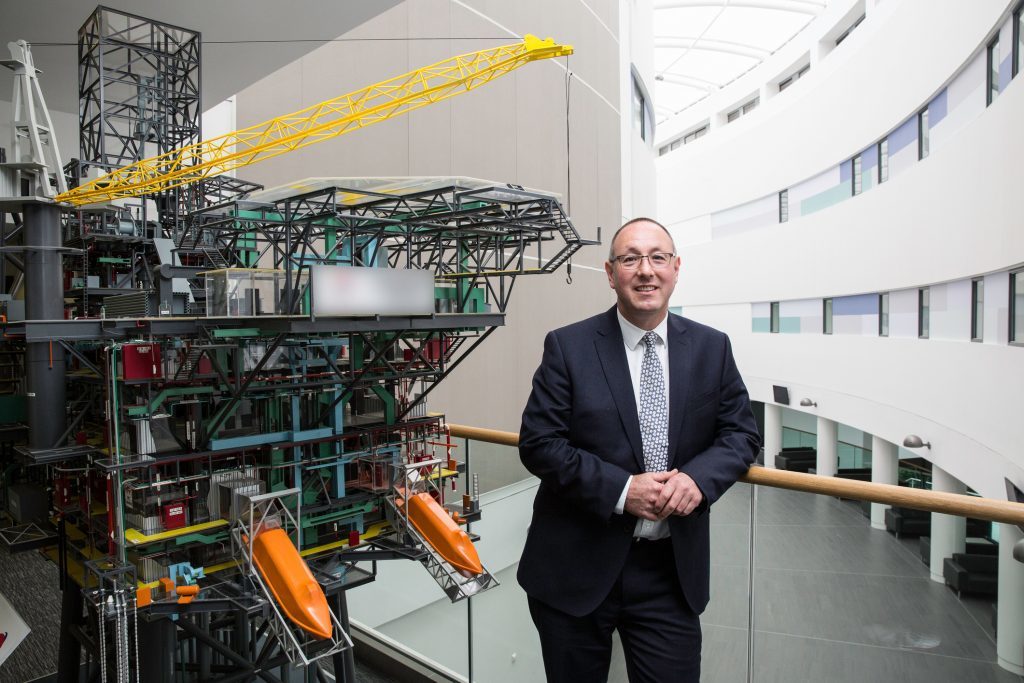

Paul de Leeuw, director of Robert Gordon University’s Oil and Gas Institute in Aberdeen, claims the recent handover of historic assets signals a sea change across the struggling sector.

Both BP and Shell have sold off major North Sea assets in the first few weeks of the year.

BP handed operatorship of one of the region;’s oldest fields – the Magnus – along with control of the Sullom Voe processing terminal to Aberdeen based EnQuest last week.

And Shell has also agreed to sell £3billion of assets to Chrysaor in a landmark deal.

The moves by the supermajors will likely inject a high degree of interest in the region after two years of slumped activity on the UKCS, claims de Leeuw.

He said: “With the memories of 2016 fading fast, it is great to see that 2017 is starting with a real positive momentum and with a renewed interest in North Sea asset deals.

“Siccar Point Energy completed its acquisition of OMV’s assets in the North Sea, BP announced the sale of a share in its iconic Magnus field to Enquest and Chrysaor announced that it is buying a large package of UK North Sea assets from Shell.

“There is still a lot to play for in the North Sea and it is great see that the confidence in the market is returning. Maximising economic recovery will require a new approach and the Chrysaor deal is yet another step in the right direction.”