Statoil has successfully continued to drive the total costs for its flagship Johan Sverdrup development down.

The firm today said it had improved the development bill from an original estimate of NOK208billion to between NOK 137-152billion.

Johan Sverdrup’s phase one break-even cost is below $20 per barrel. Phase two is expected to be below $30 and the final break even cost is expected to be below $25 per barrel.

Statoil is the operator of the field with a 40% stake. Lundin Norway ons 22%, Petoro owns 17%, Det norske oljeselskap owns 11% and Maersk Oil owns 8%.

The recoverable resource base has improved from between 1.7 to 3 billion to between 2 and 3 billion barrels of oil equivalents.

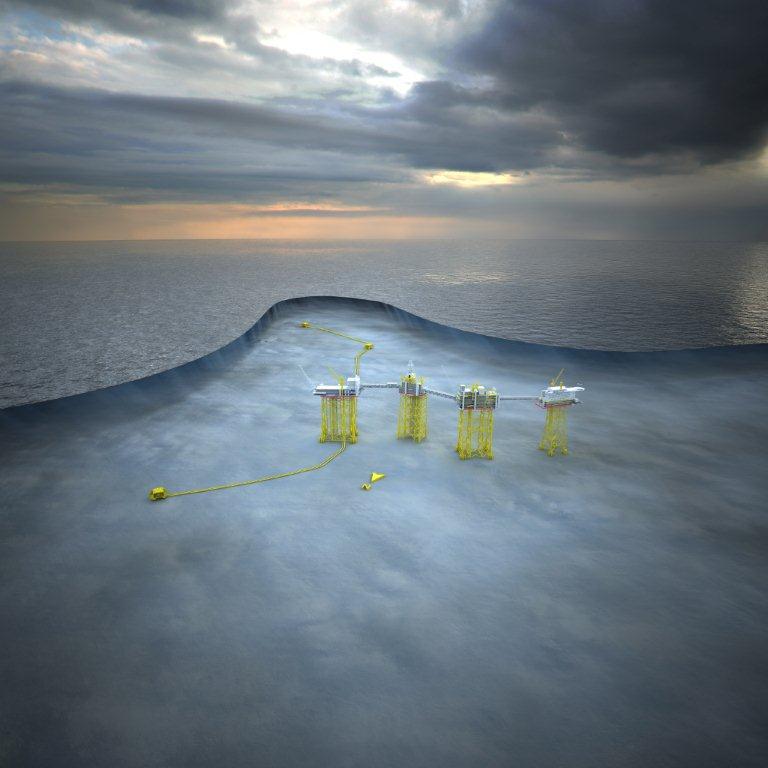

Johan Sverdrup is one of the five largest oil fields on the Norwegian continental shelf.

Peak production will constitute 25% of all Norwegian petroleum production at the time.

It’s located on the Utsira Height in the North Sea, 160 kilometres west of Stavanger.

Oil from the field will be piped to the Mongstad terminal in Hordaland. Gas will be transported via Statpipe to the Kårstø processing plant in North Rogaland. The project’s stimated corporation tax paid to the Norwegian state will be NOK 670billion.

Start-up is expected in late 2019. The cost reduction confirmation comes on the same day Statoil recorded a fourth quarter loss. Read more here.