BP has renewed its commitment to the North Sea oil and gas industry with a pledge to be a “jobs generator” for the struggling sector.

The vow came as the global operator posted a headline profit of $115million for the year ending 2016 – a substantial increase on 2015’s $6.5billion loss.

The oil and gas supermajor has also stripped $7billion out of its cost base since the price of Brent crude started its downward plunge in 2014.

Last month BP sold off a 25 per cent stake in the Magnus development – one of the North Sea’s oldest oil fields.

Aberdeen based firm EnQuest took on responsibility for operating the field and the Sullom Voe gas processing terminal on Shetland in the landmark $85million deal.

Around 100 BP staff linked with the two facilities will transfer to EnQuest as a result of the agreement, which is the first major sign of industry optimism in more than two years.

The changing of the guard at the Magnus, which was discovered in 1974, was hailed as “the beginning of a new era” by industry experts.

But it also raised fears that BP, one of the largest and longest-serving players in the North Sea, may be looking to make an exit from the mature basin.

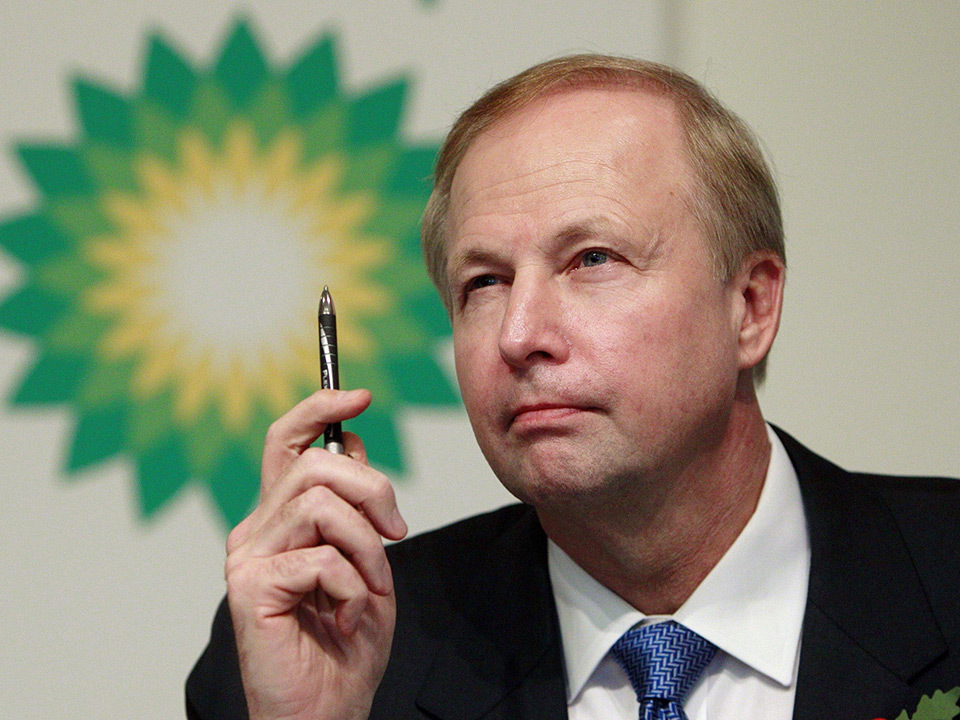

However, after sharing the “solid results” of 2016 with investors yesterday, BP chief executive Bob Dudley moved quickly to quell any concerns that recent asset handovers would spell the end of the firm’s investment in UK waters.

Mr Dudley said that the firm remained “very bullish” on the North Sea, although he refused to be drawn on the number of jobs or investment likely to be seen in the region in the coming years.

Several North Sea projects are expected to come onstream later this year, including the West of Shetland’s Clair Ridge development and the Quad 204 project for expanding recovery from the Schiehallion field.

In the last year BP has also doubled its interest in Maersk Oil’s Culzean ‘mega-find’ near the Norwegian border, to 32 per cent.

And despite admitting that the supermajor’s strength lies with exploiting massive new finds, Mr Dudley said there will be asset handovers and other projects to create growth.

Mr Dudley added: “This is a heartland for BP.

“I think you see nothing but commitment from us. We will always be looking for simplifying and making sure we are doing things efficiently but the majority of that is behind us.

“We’ve put $8 to $10billion pounds into the North Sea over the last number of years and we are still going with that – there’s a deep commitment there.

“We’re planning up to five exploration wells in 2017 and we’ve got about 50 development wells over the next three or four years coming.

“If we are successful, we will be a jobs generator for the North Sea.”

Other North Sea developments for 2017 include the drilling of Statoil’s East of Shetland Jock Scott prospect, which BP have a 25 per cent interest in and other prospects on the west of the island in conjunction with operator Nexen.

BP’s full year results were bolstered for 2016 with a lessening of the total number of payouts in connection with the 2010 Deepwater Horizon disaster in the Gulf of Mexico.

Streamlining of the company’s upstream and downstream operations also helped to bring the accounts back out of the red.

Mr Dudley admitted the oil major had no plans to rely on a price increase to $60 a barrel and instead said they had forecast for mid-$50 oil for the foreseeable future.

But he warned market stability would depend on OPEC and non-OPEC countries seeing through their commitment to production cuts, designed to reduce an a glut of reserves.

Speaking at the start of the fourth quarter and full-year results for 2016, Mr Dudley said: “As we stand today Brent oil prices have arisen by around 10 dollars per barrel since the OPEC deal was announced we still expect oil demand growth to be strong this year at 1.3million barrels per day with modest growth in non-OPEC supply – which means the timing and extent of market re-balancing depends heavily on OPEC behaviour.”

The BP chief executive said the physical market was showing signs of tightening with inventories “falling a little faster than seasonal norms”.

He added: “We expect much of the historical overhang to be eroded by the end of 2017 if OPEC and non OPEC producers deliver on their promised production cuts.

“Any shortfall could delay this process and does still pose some downside risk to prices in the near term.”

Recommended for you