ExxonMobil (NYSE:XOM) has acquired a 25% interest in a natural gas-rich block off the coast of Mozambique in a $2.8billion deal.

The American supermajor has signed a sale and purchase agreement with Italian energy giant Eni for the indirect interest.

Eni currently holds a 50% indirect share in the block through a 71.4% stake in Eni East Africa, which owns 70% of the block

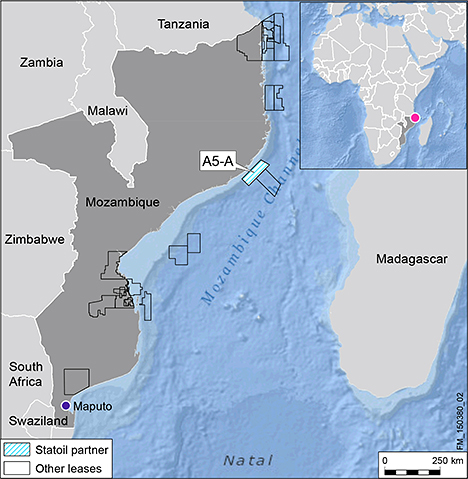

The deepwater Area 4 block contains an estimated 85 trillion cubic feet of natural gas, which will provide resources for a major liquefied natural gas (LNG) project.

Project partners expect to invest tens of billions of dollars into the development.

The agreed terms include a cash price of approximately $2.8 billion. The acquisition will be completed following satisfaction of a number of conditions precedent, including clearance from Mozambican and other regulatory authorities.

Darren W. Woods, chairman and chief executive officer of ExxonMobil, said the asset is a major addition to the company’s global development portfolio.

“This strategic investment will enable ExxonMobil’s LNG leadership and experience to support development of Mozambique’s abundant natural gas resources.

“Our industry-leading project execution, advanced technologies, financial strength and marketing capabilities will help deliver reliable, affordable energy to customers and create long-term economic value for the people of Mozambique, project partners and ExxonMobil shareholders.”

Eni will continue to lead the Coral floating LNG project and all upstream operations in Area 4.

ExxonMobil will lead the construction and operation of natural gas liquefaction facilities onshore.

Following completion of the transaction, Eni East Africa S.p.A. will be co-owned by Eni (35.7 %), ExxonMobil (35.7 %) and CNPC (28.6 %). The remaining interests in Area 4 are held by Empresa Nacional de Hidrocarbonetos de Mozambique E.P. (ENH, 10 %), Kogas (10 %) and Galp Energia (10 %).