Statoil was today given the green light for its 76 million barrel Trestakk development.

The Norwegian authorities approved the operator’s plan for development and operations (PDO).

Trestakk was discovered in 1986. The majority of its recoverable volumes is oil. Statoil has managed to strip 50% of the development costs out since first concept.

“This is a good example of what we are able to achieve in collaboration with our licence partners and suppliers by innovative thinking, and spending enough time on maturing the best concept choice. Trestakk is an important contribution in maintaining activities on the Norwegian continental shelf,” said Torger Rød, head of project development in Statoil.

The first estimates for developing Trestakk were around NOK10billion. At the time of concept choice in January 2016, the costs had been reduced to NOK7billion. Based on further improvements and concept adjustments up till investment decision, the costs were reduced to NOK5.5billion.

“This shows what the industry has achieved in just a few years. The Norwegian supplier industry has demonstrated its ability to help find high quality and cost-efficient solutions that enable us to realise projects like Trestakk, even in a low oil price environment,” said Rød.

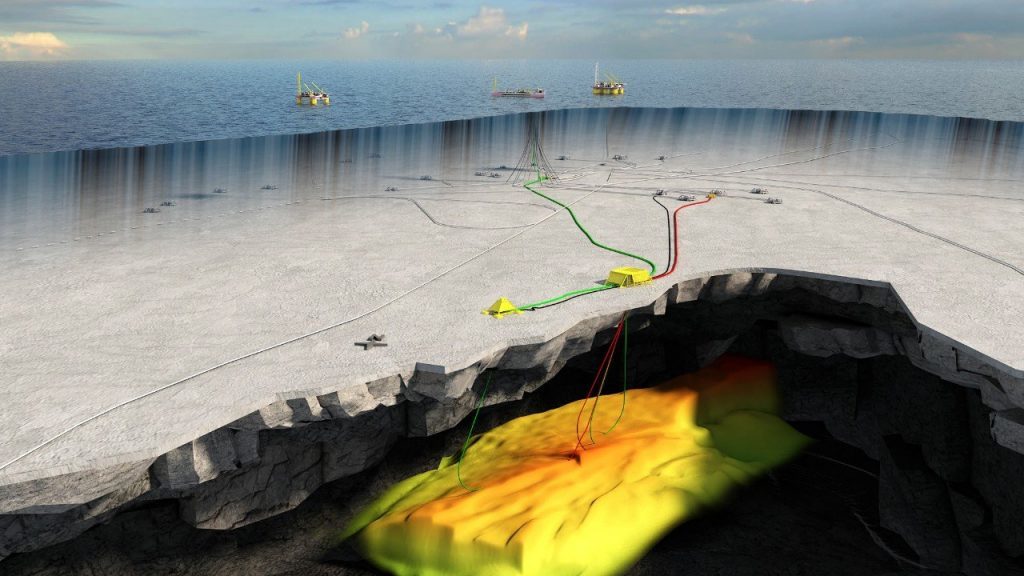

The field, which will be tied into the Asgard A production vessel, is expected to come on stream in 2019.

The field development comprises of a subsea template and a tied-in satellite well. Three production wells and two gas injection wells will be drilled.

“The Trestakk volumes are an important contributor in maintaining profitable operation of the Åsgard A vessel up to 2030. It also enables us to extract more of the original Åsgard field volumes,” added Siri Espedal Kindem, head of the operations north cluster in Statoil.

Statoil has an operator stake of 59.1%. Exxon owns 33% and Eni owns the reaming 7.9%.

The field is located approximately 20 kilometres south of the Åsgard field in a water depth of 300 metres. The reservoir is located at a depth of 3,900 metres.

Recommended for you