The newly formed Echo Energy, which replaces Independent Resources, today outlined its strategy for growth.

The firm, headed by chairman James Parsons, is looking to “rapidly” expand its portfolio in South America.

Parsons said: “We see the current environment as one of genuine opportunity for growth focused exploration and production companies. There is a window of opportunity for an ambitious Company, such as Echo, with supportive backers, existing partnerships and strong regional connectivity to quickly build a portfolio of high impact exploration and appraisal assets on attractive entry terms.

“Today we are pleased to confirm our regional gas strategy which is hinged on high quality multi Tcf potential acreage that will attract majors when the cycle turns. As a board we are extremely well connected across the sector and the LATAM region and we look forward to deploying those relationships to build Echo Energy into a mid cap company.”

The company believes that “the combination of recently increasing growth across the region and the increasing shortage of gas in the major markets of Brazil and Argentina, together with a historic period of regional underinvestment in the sector provides a compelling investment proposition for investors at this specific point in the cycle”.

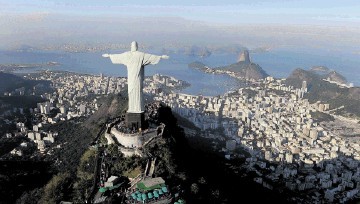

It is targeting acquisitions in Bolivia, Colombia and Brazil.

In anticipation of its first asset acquisition, the company has today signed non binding heads for further institutional investment of approximately £23 million, before expenses. It is anticipated these funds, net of expenses, will be deployed to evaluate, drill and develop any acquired assets.

At the same time, it plans to exit its Italy and Egypt operations.

A spokesperson added: “The company confirms it is in discussions with a third party to sell its Egyptian asset and will update the market further as appropriate. The Tunisian portfolio remains under review.”

Recommended for you